Business

Beanie Babies or Bitcoins?

Geoffrey Gardiner is one of the smartest, most knowledgeable banking mavens I know. I only quibble when he suggests, “[Bitcoin is] a very clever practical joke by someone who is having enormous fun exposing in the most sophisticated way imaginable the naivety of clever mathematicians, economists and/or rich speculators…[or] The cleverest con trick ever conceived,” because he is too kind to say ignorance was the cause. But ignorance, propagated through a community of bright people, is what I think. For a more academic analysis of the errors of bitcoin, my analysis, “The False Premises and Promises of Bitcoin,” could be useful. Here I will limit it to the most core problems: the scarce commodity currency idea (i.e. gold standard) is wrong; the Federal Reserve is what keeps us all afloat; and it is impossible to run a bank with bitcoin. The most primary error lies in the assumption that the gold standard was something good, and therefore, bitcoin should be modeled on gold.

For those not familiar with bitcoin and its beginnings, bitcoin was created by Satoshi Nakamoto. NPR’s Emily Siner explains how elusive he has been. “The hook is, no one actually knows who Satoshi Nakamoto is,” Siner writes. “In 2008, he/she/they released a detailed concept for a self-regulating crypto-currency and wrote a whole bunch of incredible code to support it. But Satoshi Nakamoto stopped responding to emails in 2011. It’s been a wild goose chase ever since. Satoshi Nakamoto’s concept is that of a democratically organized currency: no government regulation, no centralized bank. It’s been embraced by, among others, libertarians trying to undermine monetary regulation policies and entrepreneurs trying to avoid financial corruption in developing countries.”

Satoshi has recently been identified as Nick Szabo, though he has not confirmed this. Nick is a former professor of law and computer science. Whether Geoffrey’s thought that bitcoin is a trick designed to showcase its errors is correct, or my belief that it was an ignorant mistake may be settled someday. Perhaps Satoshi Nakamoto will come forward and tell us. But maybe Nakamoto prefers to let us decide for ourselves. In any case, most everyone publicly involved with bitcoin appears to be, unwittingly, standing on a foundation of errors.

The first error: the Gold Standard

Many today look to Ludwig von Mises, an Austrian economist, and a contemporary of Keynes. There’s even an institute dedicated to Mises. But Mises abandoned most of those ideas during his lifetime.

Mises was a smart guy, and his Misean regression theorem is still bedrock stuff. He explored the mystery of why on earth anyone believes that “money” is worth anything. His conclusion is that we believe this because everyone else does. Gold is shiny and easy to work with, and somewhat rare. It doesn’t tarnish. But it’s not particularly useful for making swords, axes, or even forks and regular knives, nor any other tools of the old world because it’s soft as metal goes. So why do we fixate on gold? Maybe it’s because we share a fondness for shiny things. But people have used everything from shells and feathers to huge rocks as money. Gold is no less arbitrary. And this is key – gold is just as abstract in its “money-ness” as anything else is.

But back to the gold standard. Why is it a bad idea? And why was it abandoned? The answer is simple: “not enough.”

Just look at the population increase in the world. All these people need money to purchase goods and services. If we say that we need gold reserves equal to all the monetary banking reserves in the world, then we are saying we have to have enough gold so that the amount of gold per person at least stays the same!

You scratch your head and say, “Well, if we don’t find more gold, that just means that the gold we have will be worth more.” And that sounds like a great thing – if you have gold. But let’s ignore everybody who wouldn’t have gold – because it doesn’t really matter – most of those who do have gold are still screwed if money is deflating. Why? Because some inflation is a good thing.

What? How can inflation be good? It’s good because of loans. In our world, almost all the money is created from loans. Most people don’t realize that when a bank loans you money, they are creating money. It’s called “Credit money.” Today, (and for centuries past) virtually all money is credit money. Every dollar you or anyone else has is a debt somewhere else. Central banks like the Federal Reserve have the job of making sure that credit never dries up. (This is also why, in itself, a national debt is not a bad thing. Because every dollar of that debt becomes a dollar someone else has – actually more than one dollar because of the banking multiplier, but we will get to that.)

So back to loans and inflation. There are two things that make inflation good for loans. First, as you pay off the loan, it gets a little cheaper as time goes on. It gets cheaper because the money is worth a little less, so if you adjust for inflation, your true interest rate is lower. Second, let’s contrast that with what happens if the money you pay the loan off with is worth more every year. That means that it will be harder to make money. So the true interest rate you are paying is higher. Let’s look at the calculation.

If your interest rate is 1% per month then the calculation looks like this: 1.0112 = 1.1268, or 12.68% total interest per year. But if the money is getting more valuable by just half of a percent per month, (or around 6% per year) then your real interest rate looks like this: 1.01 x 1.005 = 1.01505 and 1.0150512 = 1.196, or 19.6% interest. So you pay almost 7% more in real interest, if the money you use is worth only 6% more every year. For most businesses that is a big bite out of profits. In many cases, with low margin businesses, that’s all the profit.

This is why deflation occurs in depressions. Remember that most money is credit money, and when someone defaults on a loan because they can’t pay it, then that money disappears. This becomes a cycle. When one loan isn’t paid, then someone else can’t get paid by that business which means another loan can’t be paid, and things collapse. Banks don’t really want collateral – they want the money. And when things are going downhill, banks end up with lots of collateral, like factories or farms that they just don’t have the skills to operate, and nobody has the money to pay the collateral value price.

Deflation and the gold standard

The worst part of deflation is that if you have money (let’s call it gold) and every month your money is worth more, then your motivation is to hold onto your money. And if you know that when you loan your money out, it has a real good chance of not getting paid back, then you won’t. But it gets worse than that.

When deflation gets large enough, then to make money, banks have to charge people to keep their money in the bank. Interest rates can’t go lower than zero. If deflation is high enough, then people take their money out of the bank. When that happens, it is no longer available to make loans for reserve banking. This is called hoarding. Hoarding, means that you have it, and nobody else can make use of it. Because of reserve banking, when you put money in a bank, others can make use of that money. Hoarding money is different from saving money, because of banking – when you save, your money becomes available to society.

All of that deflation problem must happen when you don’t get enough gold and you are on a gold standard. Everyone is screwed, except those with a whole lot of gold. In practice, history says that often those with a lot are screwed too, because somebody comes and takes their gold. That’s the way the world used to operate – armies plundering each other’s nations for what was valuable.

But probably the worst thing about deflation is that, when loans can’t be made, then innovation stagnates. That means that in reality, those who have all the gold also suffer – they just don’t know it because they don’t ever see the new things they might have had. This too is how the world used to work in ancient times.

The second fundamental error: Federal Reserve

There is an idea bandied about that the Federal Reserve is a bad thing, that “The Fed” is a diabolical plot, “debasing our money!”

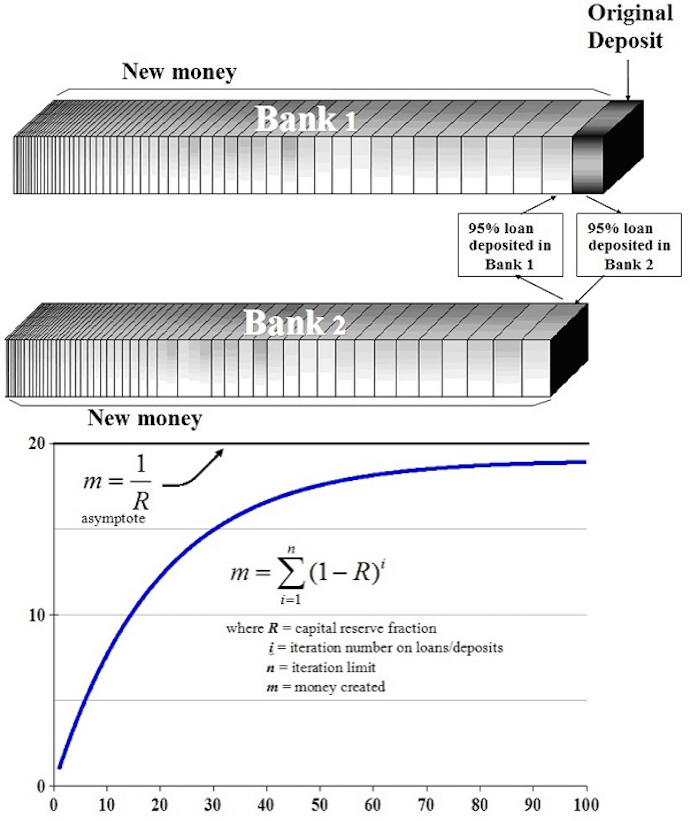

Nothing could be further from the truth. Seriously. I’m not going to go through a full discussion of how loans and banking expand the money supply using credit. Look up the “Banking Multiplier” on Wikipedia. Here’s a picture of how money expands from a reserve if you have to keep 5% reserves in your bank. Look at that blue line.

Each time a loan is made, it becomes a new deposit of a bank. The width of each brick in the above diagram is proportional to its size. The size of each loan declines because of reserve requirements. Equations of the banking multiplier are on the right. In practice, there are usually limits to the banking multiplier, because originating a loan takes significant time. In practice, you also don’t get a nice, clean complete loan each time. This is a simplified, “teaching model.”

That blue line rises really fast at first. But then it flattens out as the number of loans off the original reserve goes up. As we go to the right, more loans are done, but with each loan, the smaller the amount of credit money that is possible to loan. So if you have a gold standard, and you can’t find enough gold, what this means is you boom and then you bust. You get way out there where it has flattened out, something goes bump in the night, and everything collapses back.

In history, that is exactly what we see during the time of the gold standard. Hundreds of years of boom and bust, over and over again. Once you understand why, it becomes obvious what the solution is – get rid of the gold standard. The gold standard is an artificial control on the real economy.

You see, the “real economy” is real stuff, not numbers in a ledger. The real economy is houses, and cars, and guys going out to fix your plumbing. The real economy is airplanes and farming and food on the table. Money? Money is just what we have all agreed on to measure that.

North America saw many religious communes that didn’t use money inside. By the time of the revolution, we had almost 200 years of such religious communes, mostly in what became the United States. From Oneida (which comes down to us as Oneida Silver) to Amana (which gave us the appliance company) and the Hutterites, these communes were very successful. The Hutterites in Canada are so successful today that only recently have they been allowed to buy land again. But even for groups that can run based on trust alone, outside the group they use money.

So, we are now on the “productivity standard” and the Federal Reserve has the job of making sure that if a loan can be made, there is always enough money to do it with. All that fuss about the money supply is precisely about this issue. And everybody is doing the same thing now. Every major nation has a central bank.

The Federal Reserve is not debasing money, it’s making sure the money merry-go-round doesn’t stop. Of all the institutions today, the Federal Reserve and the other central banks are working well. If they weren’t we would be in a world of hurt. Nobody else is doing their job very well in the world economy except the central banks. Not perfect, no. And the ECB has a structural problem, because the Euro has ended up acting like gold for many nations of the EU. But really, you should send them flowers – or chocolate chip cookies – to thank them. Yes, we still have some degree of boom and bust, like with the 2008 banking crisis – but for different reasons. I wrote a paper on a major aspect of that too.

The third error: Banking with bitcoin is impossible

A long time ago, there was no banking, and there were caravans carrying gold, silver and products from place to place. Robbing the caravans was great business. So, a system grew up to replace it. Powerful people would keep the gold in a vault where it was safe from all but the most determined force. They would send letters with seals on them to each other, saying, “Credit this guy for X amount.” Today, this is still done – it’s the hawala system of money transfer. That system comes down to us in banking today as the “letter of credit.” Businesses still get those for some transactions, particularly big ones, where the goods are going a long way.

Some smart guys, who we might call con-men today, realized that nobody was actually looking at their vaults anymore. They just looked at the books the vault operators kept. And they started to give out loans in amounts more than they actually had in storage. Of course, they didn’t tell anyone. One of the early families in this game was the Medicis. Way back then, those banking guys didn’t usually go past loaning out double what they had. They were nervous. If their scam got exposed, they could be murdered in an uprising. They were pulling a fast one of sorts. And they were making out like bandits. Go visit Florence if you doubt they did.

What started out by conning people became the basis of Western civilization, and then all of civilization – because it worked so well. It made huge amounts of money available by a brand new mechanism – the judgment of smart people who were not politicians. This had huge repercussions. Over time it made royal families beholden. It made it possible to get money in the present for a future promise to deliver – if the banker believed you. Banking was, in Silicon Valley-speak, “massively disruptive.”

These days, banking is very formalized. The USA’s rulebook is over a thousand pages. We have international rules called the Basel Accords, and the Bank for International Settlements. Reserves can range from around 7% to less than 2%. And we talk about a fundamental problem that still exists with banking, “moral hazard.” This is the temptation that comes with the power to create money to abuse it. It think that those involved with bitcoin recognize moral hazard, and it may have been part of the motivation for creating it.

But, you can’t do reserve banking with bitcoin, because bitcoin goes farther than gold. Gold is inconvenient to carry around. It’s bulky. It’s heavy. So people don’t want to carry it. Bitcoin is weightless, trivial to steal, trivial to carry around. You could carry all bitcoins ever made on a thumb drive. So there is no particular incentive to put bitcoins in a vault and start accounting for them using a ledger. All bitcoins are, really is encryption keys.

You could argue that because they are so easily stolen, that’s an incentive to keep them in a vault run by people who know how to protect them. But the evidence is that putting your bitcoins in a vault makes them less safe. Because a bitcoin can be stolen just by copying it. There isn’t any record that it was copied. But if gold is stolen, it’s obviously gone. Unless you keep track of all of your bitcoins yourself, separately from the vault, and watch for them to appear in the bitcoin blockchain, you won’t ever know they were stolen until you try to use them and find out they are already used. And that’s that.

If you look around you, almost everything you look at exists because a loan was made that can be traced back to a bank. The computer you read this on, the table it sits on, the building you are in, the car you drive, the food you eat, all of it. Banking creates money by giving credit “on paper.” We allow banks to do this. But you can’t do it with bitcoin, because bitcoin forces unification of the unit of account and the unit of currency.

The unit of account is your bookkeeping, and the bookkeeping breaking free of the physical money symbol we used to use is what allowed banking to start in the first place. Here’s a picture:

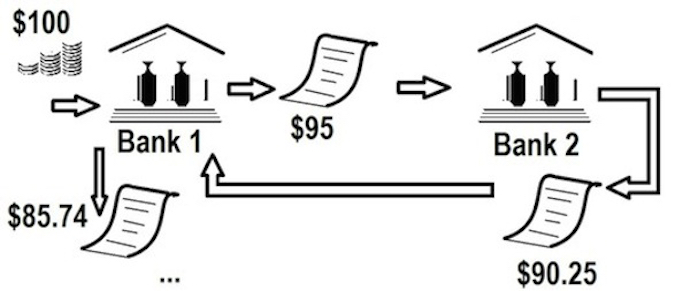

An initial hard currency (gold) deposit is entered into the books of Bank 1. Loan paper is created of 95% of the reserve. This is “virtual money” deposited into Bank 2. Bank 2 credits this virtual money and makes a new loan, of 95% loan which is deposited into Bank 1, and that in turn is accepted on Bank 1’s books, a new loan is made, etc. The result is $95 + $90.25 + $85.74 = $189.49. And that money creation can continue to the theoretical 1/r limit, where r is the reserve fraction required.

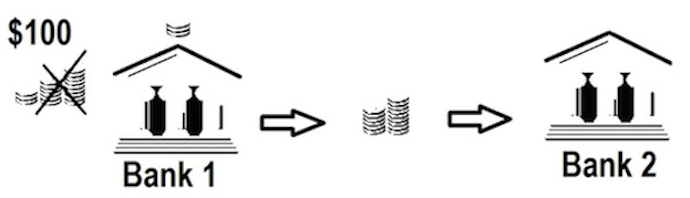

An initial gold deposit is placed in Bank 1 and logged into its books. Loan paper is created of 95% of the deposit. But this time the loan must be redeemed inside Bank 1 for the $95 in physical coin, and is carried out of bank 1 to deposit into Bank 2. When it is done, Bank 1 has $5 in coin and Bank 2 has $95 in coin. There is no change in the amount of money in the system, because no new money has been created by credit.

The only way to implement bitcoin reserve banking is by creating something new. We can do it by allocating a new “virtual-bitcoin” to the depositor for 95% of the value of his deposit. Or, we can allocate the loan as virtual-bitcoin, usable as if it were bitcoin, but not actually real bitcoin. But virtual-bitcoin is precisely the kind of money that bitcoin was designed to prevent, because bitcoin’s designers did not think the problem through.

So no banking with bitcoin, and that means no serious loan activity with bitcoin. No money multiplier means that loans without banking are a losers game. Far from a step into the future of money, bitcoin is a throwback to biblical times when all money was hard currency.

There’s more that bitcoin got wrong

Yeah, there’s more. For instance – there is an ironic problem with the fundamental technical architecture that means bitcoin can be taken over by any entity with enough resources. Once that happens, they can do anything they want with bitcoin, including create more bitcoins than are supposed to be created, double spend bitcoins, whatever they want. A potential takeover almost happened recently. That means a government agency could throw a ton of computing resources at it any time they want, and voila – bitcoin becomes a government entity.

But in economic terms, it all comes back to these fundamental things.

You can’t do banking with bitcoin. And you can’t create a healthy economic environment based on what Keynes called the “barbarous relic” of the gold standard. Money based on scarcity is not just a little wrong – it’s way wrong.

To support a healthy economy, money must be controlled at just the right rate. Not too much, and not too little. That is what “the Fed” does.

You may not like needing to participate in making government work properly, but a bunch of guys are not going to revolutionize the world with a poorly thought out anarchist currency idea. Not going to happen. Not even Julian Assange would love this anarchist idea nor think it’s totally cool. He doesn’t understand money in the modern world either.

Sorry.