Greece Has Reached Its Threshold of Pain

It should not have come as a surprise that the majority of Greek voters opted not to accept more externally-imposed austerity, by voting “no” in Sunday’s referendum. The election pollsters once again were proven wrong. It was not a close race with those Greeks who wanted to stay in the Euro and add more to the country’s obviously untenable debt burden. The majority of Greeks have now said they would rather leave the Euro and repudiate their external debt rather than endure possibly decades more of painful austerity. Every country has a threshold of pain, and Greece has reached it.

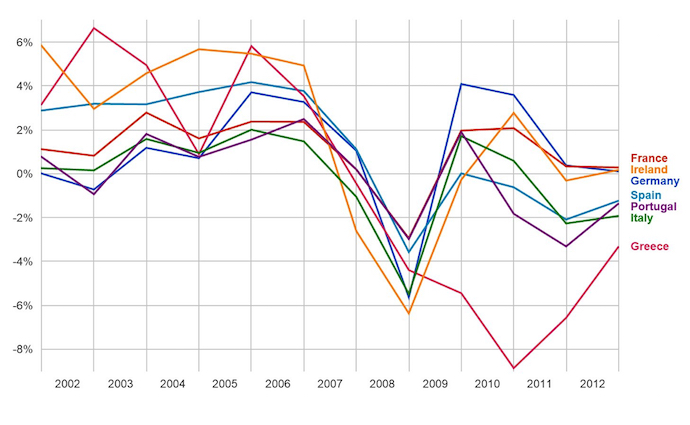

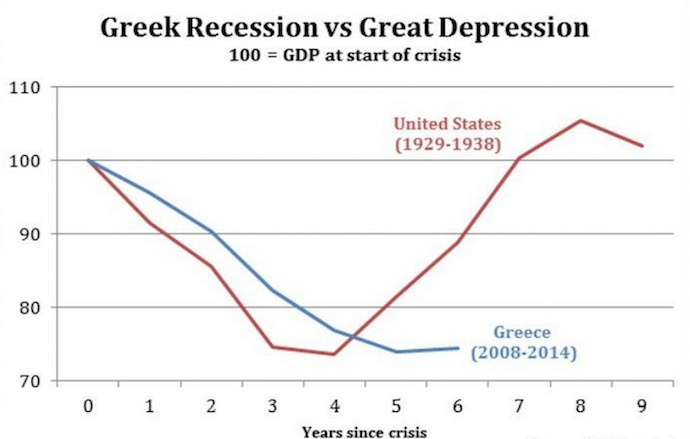

Greece has often lagged behind its European brethren in a host of indicators, but none serves to signify the depth of its pain since 2008 better than its GDP vis-à-vis the PIIGS, France and Germany (as noted below). While all these other countries rebounded since 2009, Greece’s GDP continued to plummet until 2011, and has struggled to catch up ever since. As is noted in the second chart that follows, if Greece’s GDP is compared to the performance of the USA following the Great Depression, it has fared worse for far longer. Greek GDP per capita fell nearly 20% from $26,900 in 2010 to $21,700 in 2014 in current US dollars. That’s 20% in just four years.

Comparison of Selected European GDP: 2003-2013

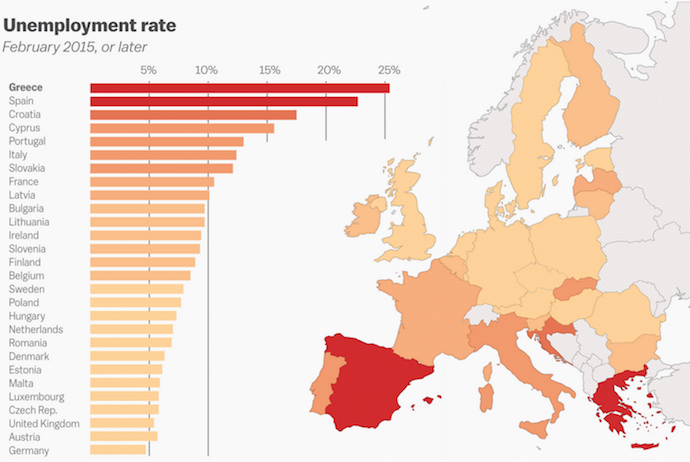

Some 45% of Greek pensioners are now living below the poverty line. Their pensions, which amount to no more than €665 per month, have been cut 44-48% since 2010. The Greek suicide rate jumped 35 percent during the peak of the crisis in 2011 and 2012 (Greece’s suicide rate used to be the lowest in Europe). Adult unemployment exceeds 25%, and youth unemployment has reached more than 60 percent. Approximately 55 percent of those unemployed are under 35.

As Greek Prime Minister Alexis Tsipras recently said in an interview with Italian newspaper Corriere della Sera, “In five years in Greece, we have cut pensions by 44 percent, reduced private sector pay by 32 percent, destroyed the job market, smashed the welfare state, bled employees and the middle class dry with taxes, and reached one and a half million unemployed in a country with an active population of six million.” By any measure, this is simply unsustainable. Apart from war time, no developed country in the world has endured, nor continues to endure this kind of sustained pain. Faced with similar conditions, voters in many other developed countries would undoubtedly vote similarly.

Responsibility for Greece’s (and now the EU’s) dilemma rests with all parties – Greece, the ECB, the IMF, and the banks. Greece certainly bears a large share of the blame, with its bloated bureaucracy and fiscal negligence, which persisted for decades. Each party is now so busy pointing fingers at everyone else they appear to have lost any sense of introspection (if they ever had it to begin with). It took all of them get into this mess, and it will take all of them to get out of it. This means that all the parties must be willing bear their fair share of blame and pain if there is to be a solution to Greece’s, and Europe’s, debt problems.

European governments wanted so badly for the Euro and EU to be created that they looked the other way when any of them were clearly not eligible to become (and stay) members under the budget deficit guidelines, but were allowed to do so anyway. They are all now paying the price.

The EU and Euro ‘experiments’ are, in the end, textbook cases of market failure, because ‘the market’ did not work. Some member countries simply lied to get in, there weren’t adequate regulatory mechanisms in place to ensure that the EU’s own debt guidelines were adhered to, and there were no immediate consequences if they were not.

Europe’s (and the world’s) banking system is crumbling under the weight of its own hubris, largesse, and irresponsible lending. Given that Greece’s debt can clearly never be repaid, lenders should get their head around the reality that it must be largely written off – and the sooner the better. The same will likely prove to be true for the other Highly Indebted European Countries. It should be abundantly clear to everyone by now that throwing more money into a black hole (Greece) hasn’t worked, and isn’t going to work.

So, what happens now? An orderly unwinding of Greece’s and Europe’s debt is possible. If it could be done in the U.S., when a third of all savings and loans associations failed in the 1980s and 1990s, something similar can be done in Europe. Doing so will clearly be painful, and the European tax payer will undoubtedly be left holding much of the bag. But they are doing so now, with no end in sight. It is time to stare reality in the face, admit that the EU economic and financial experiment has been a failure, that the debt burden created by the EU is unsustainable, and that there is little point in delaying the inevitable.

Clearly, Greece needs to figure out a way to grow, but this will not occur before the Greek people endure substantially more pain. At least, in their mind, it will be on their own terms (to some extent). The troika must now consider how to keep Greece at the negotiating table, given the new landscape, while giving Greece the ability to say that it is negotiating on its own terms. The troika must also think about how to keep the anti-austerity movement from prompting another referendum, with the possibility that another Heavily Indebted European Country may spin out of the EU’s orbit.

What is crystal clear is that piling more debt upon more debt — so that the lenders can loan more money to pay themselves interest payments – is not going to work. There is certainly an argument to be made that the lending/austerity path should never have been taken in the first place at the outset of the Great Recession, given how unrealistic it always was that the astounding sums of money lent were never going to be repaid. That realization has finally arrived at Europe’s doorstep. This house of cards may be about to fall.

This article was originally posted in The Manzella Report.