The Politics of China’s Anti-Monopoly Investigations

In the last few months, China has targeted over 30 foreign companies under an anti-monopoly law passed in 2008. As foreign firms increasingly depend on China’s market, Beijing has become brazen in imposing its rules. But Beijing’s actions have stirred a backlash from international businesses who accuse China of cloaking protectionist measures under the anti-monopoly law. Geoff Raby, a former Australian Ambassador to Beijing declared, “We’ve never seen anything like this before. This is big and the stakes are very high.”

At a time when the Chinese economy has shown signs of faltering, why has Beijing come out swinging with these anti-trust investigations? The context of China’s complex domestic and international politics holds the key. The attacks on Microsoft, Qualcomm and Mercedes Benz to name a few, could have never occurred without approval from the upper echelons of the Communist Party. Spearheaded by three separate government entities, the investigations have been described as aggressive and opaque by those being pursued. Crucially, foreign executives have little choice but to accept the outcomes as legal recourse in China is viewed as an implausible option.

But the anti-monopoly investigations have not been undertaken to simply harass foreign firms. International businesses have accused China of using the anti-monopoly law to favour Chinese firms, particularly state owned enterprises, at the expense of foreign firms.

For example, despite the increase of car sales in China, Chinese car manufactures account for only 21.5% of the market share in their own country, down 5.1% from last year.

The remaining market share belongs to American, German, Japanese and French brands. China’s abuse of its legislation was highlighted in a report issued by the US Chamber of Commerce which claimed that fines and other anti-monopoly directives, ‘often appear designed to advance industrial policy and boost national champions.’ The $146 million of fines handed to Volkswagen, Chrysler and Japanese auto-parts manufacturers are testament to this.

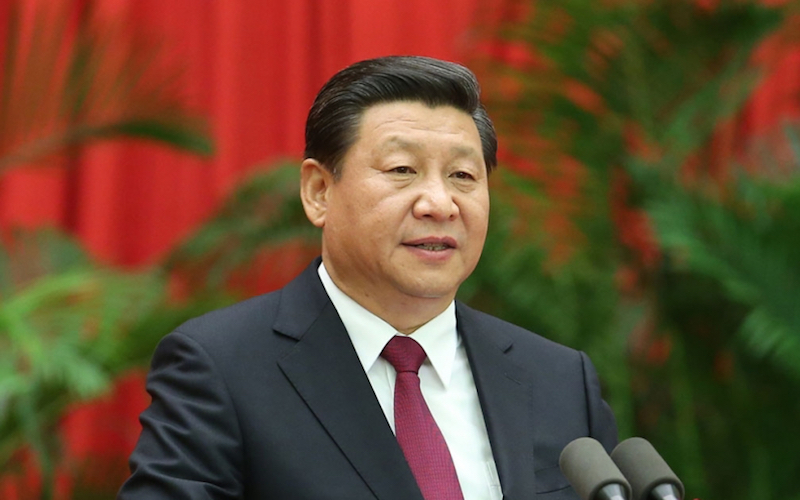

Foreign technology firms have also been targeted in Beijing’s ruthless campaign. But firms such as Qualcomm and Microsoft being investigated under the anti-monopoly law are being targeted for more intriguing reasons. The allegations against Qualcomm, a leading US phone chip manufacturer, come at a time when Beijing is seeking to implement a nationwide 4G network. Under current arrangements, Qualcomm receives royalties from every phone manufacturer in China utilising its technology. This has led to Qualcomm being accused of, ‘overcharging and abusing its market position,’ and has the potential to result in a $1 billion fine. Moreover, a recent speech in June by President Xi Jinping strongly supported Chinese ownership of important technology. “Only if core technologies are in our own hands can we truly hold the initiative in competition and development.”

It is an uncomfortable coincidence that his speech was followed only a month later by the first of the anti-trust investigations into foreign technology firms. This combined with the recent acquisition of RDA Electronics, a Chinese phone chip manufacturer, by a subsidiary of a state owned enterprise, can we better understand the murky dynamics at play behind China’s business scene. China’s anti-monopoly investigation also reflects the belief that foreign technology companies have been acting as fronts for US spying. Consequently, firms such as Google and Apple have come under heavy attack by Chinese press even before the anti-monopoly investigations began. Threatened by boycotts in the mainland, Apple was forced to apologise but not before its reputation had been damaged. Beijing was similarly aggravated when the FBI indicted five Chinese nationals for cyber hacking back in May. In light of this, the anti-trust investigations which have targeted Qualcomm and Microsoft may be part of a tit-for-tat campaign to damage their reputations in the mainland.

Beijing has stood to gain an added benefit from the anti-monopoly law: the pursuit of foreign firms has fostered positive public perceptions of the Party. Since coming to power, Xi Jinping has underlined the Party’s role as the protector of the Chinese people. Part of that role involves protecting Chinese consumers from what they perceive as the unfair pricing of foreign goods sold in China. Little matters that these goods are subjected to China’s stringent import tariffs which are ultimately responsible for their high prices. By pursuing the anti-monopoly investigations, Chinese regulators are gaining favour with the population. And while Chinese regulators have defended themselves by claiming that only 10% of the anti-monopoly investigations involve foreign firms, China’s media have noticeably focused their attention on the government’s efforts to investigate foreign companies.

As China’s economy falters, Beijing is forced to make a choice between reforms and growth. Favour reforms and growth weakens in the short term, likely causing social instability with damaging consequences for the Communist Party. Favour growth, and China’s long term survival is at stake. Latest statistics show that China’s FDI has plunged 14% compared to last year and many analysts have underlined the role anti-trust investigations are playing – 60% of foreign companies believe they are unwelcome in China, up 20% from last year. Reform favours China’s further integration into the international business community. But if the anti-monopoly investigations are a sign of anything, it seems that China has chosen its path at the expense of real structural reforms.