Dollars and Cents: Minimum Wage Implications

Henry Ford made one of the greatest business decisions ever when he instantly doubled his employees’ wages on January 5th, 1914. Suddenly the worker making $2.38 for a nine-hour day was making $5. In response to this crazy travesty of raising wages well above what anyone else was willing to pay, The Wall Street Journal said “To double the minimum wage, without regard to length of service, is to apply Biblical or spiritual principles where they do not belong.”

That Henry Ford was not liked by other captains of industry after this move, would be an understatement.

Ford didn’t necessarily raise wages to be a great guy, but because of the positive implications of raising the minimum wage. Retaining employees in such a monotonous and harsh work environment (there was no vacation at this time) was next to impossible. It actually ended up being a cost cutting move.

The cost of his automobiles did not go up as a result of this move, but down and he continued to reduce the cost of the Model T to a price point that his now better off employees could afford. In one swift move he created a new consumer class for a product that had once only been for the 1 percenters and cut costs by having a stable and engaged workforce.

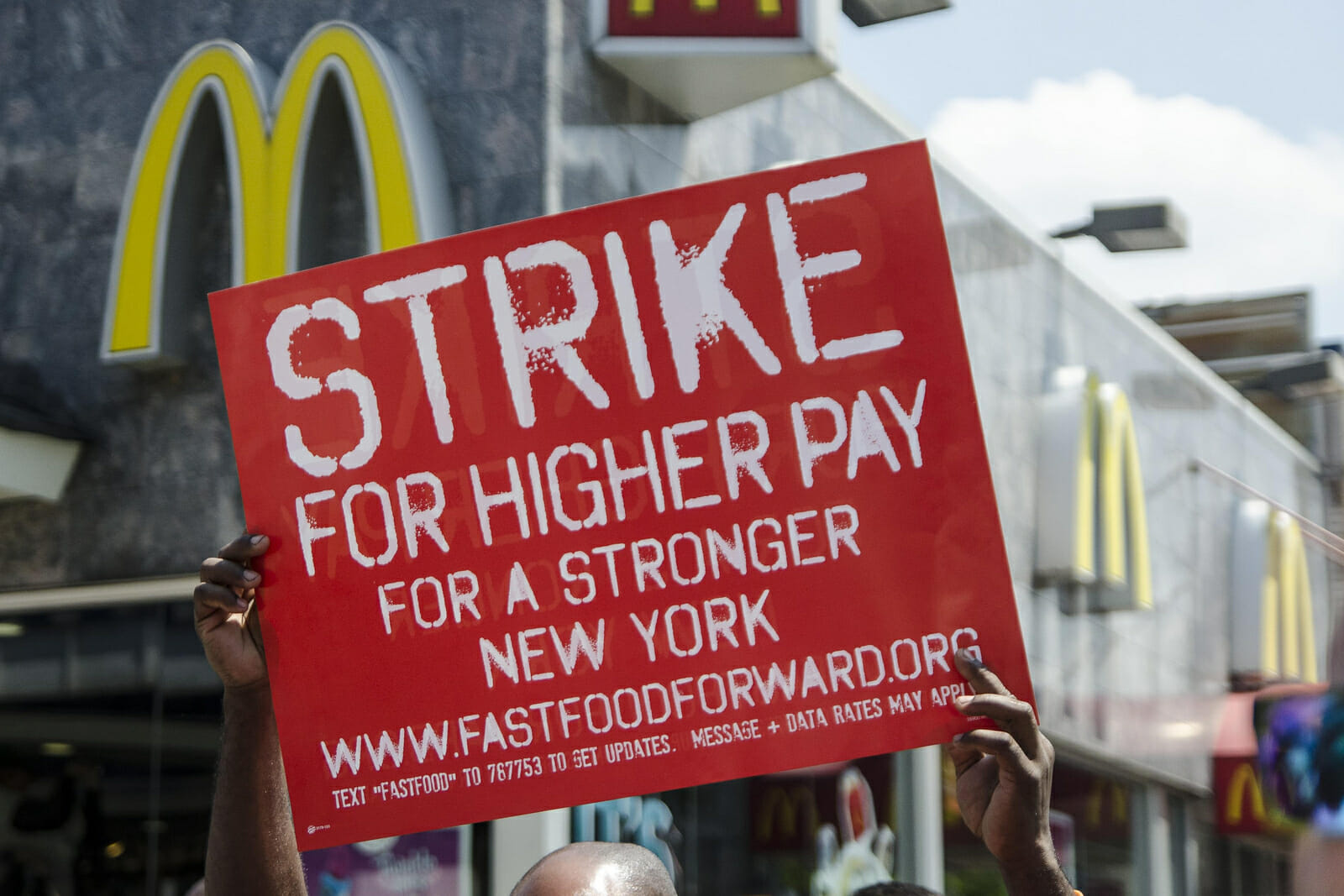

In our current economy, wages have remained stagnant. More and more people cannot afford to spend money beyond survival, so many states who need an infusion of spending along with an improved basic standard of living are raising their minimum wages. California is raising their minimum wage to $15 an hour. Seattle has done it and New York has implemented it for employees of large fast food chains. They have not raised it immediately but are phasing it in over time and the cost of a burger will not double. In fact, business owners will probably experience the Ford effect and see business increase while costs actually go down.

Let’s start with the burger price increase. One horrible assumption that is so often made is that if wages are raised by 50 percent, the cost of the product will also rise by 50 percent. That some owners of businesses have even trumpeted this fallacy implies that they do not understand basic accounting.

Prices never rise in tandem with an increase in one portion of the variable cost unless the business needs a new reason to exploit its customers. There is an accounting principle called contribution margin that always comes into play. In simple terms, it is the calculation of variable costs to figure out the amount left over to cover fixed costs. It is impacted by price, units sold, etc.

Labor, specifically labor that is part of producing or serving goods, is a variable cost in the price of that good. It is only one cost of many. A hamburger has variable costs in buns, ketchup, lettuce, etc. Labor is usually one of the biggest costs on the income statement, but still only one cost. A 25 percent increase to something that comprises 40 percent of variable costs, only increases an additional 10 percent of the variable costs. If those variable costs are 70 percent of the whole burger, that 25 percent increase means a 7 percent increase in the variable costs.

So under that equation, the price of a cheeseburger would theoretically go up 7 percent. Sure it is still more than inflation, but there is more to the story. Amazingly the cheeseburger didn’t go up 25% in its price, even though the wages did, and those employees can now feed their children. Amazing.

As wages rise, the velocity of money increases. The velocity of money increases when those at the bottom of the economic ladder experience wage gains. Because they spend everything they make, low income earners are pure velocity. As their wages increase, they mimic the Ford model in that they can now consume more cheeseburgers. The IMF calculates that every one percent of GDP that shifts to the bottom of the ladder increases 5 year GDP growth by .38 percent. Basically, more cheeseburgers get sold.

It gets even better. As more cheeseburgers get sold, the amount of contribution margin needed to cover fixed costs falls, productivity usually increases and profits go up. That their employees are actually fed, happier and not needing public assistance is a complete bonus for those businesses.

As businesses see more consumer spending, more people are hired, more money flows through the economy, businesses become more efficient and we become a more humane society.

This article could go on and on about the benefits of a minimum wage increase and bore readers in the process. Several places have become enlightened enough to start slowly raising the minimum wage and moving the process forward. However, some will find a way to spin the data that impacts America’s most disadvantaged.