The Coming Manufacturing Giant: The United States of America

One of the positive externalities of the U.S.-China trade war will be the re-emergence of the United States as one of the two dominant manufacturing powers in the world. While China enjoys a labor advantage due to its large population, it also is constrained by the poverty of its population which forces the Chinese Communist Party to seek overseas markets to finance the state-owned enterprises (SOE) which provide employment for almost 50 percent of the Chinese working population. SOEs consume 70 percent of the financial resources of China, yet only contribute 30 percent of China’s GDP.

With the rise of automation and robotics in the manufacturing process in the United States, the costs of manufacturing will decrease, and the marginal profit margin of U.S. manufacturers will increase as a result. As U.S. manufacturers continue to decrease their manufacturing costs with advanced technology, the cost of goods sold will continue to decrease and the marginal profit margin will continue to expand. With market dynamics signaling that there are additional profits to be made in manufacturing through innovative automation and robotics, companies will expand their manufacturing using automation and robotics to the point where their marginal profit margins equal zero. It is at this point that the increase in manufacturing due to automation and robotics in the U.S. will level off and plateau.

With the cost of imports from China rising, these reduced costs have made manufacturing in the United States more profitable. While China has aggressively increased its use of robotic technology and ranks number one in the purchase and installation of robotic technology, it is interesting to note that the majority of robotic technology comes from the West. Unable to manufacture the equipment needed to manufacture the equipment necessary for automation and robotics, China engages in intellectual property rights theft. This allows China to obtain the technology to manufacture this type of manufacturing equipment in China. A recent paper from the World Bank has shown that the productivity rate of Chinese manufacturing has slowed and now has a downward trend. Unless significant changes are made, Chinese manufacturing abilities will continue to decline.

From 2010 to 2016, U.S. manufacturing saw an increase of between 10 to 20 percent, yet at the same time employment in manufacturing only rose from 2 to 5 percent. The sharp increase in manufacturing is due to the increasing use of technology in the manufacture of goods for sale. Clearly the use of automation and robotics in manufacturing in the U.S. have decreased costs yet increased productivity. These trends will only become more pronounced in the future. Economist Larry Summers has written that “if current trends continue, it could be well that a generation from now a quarter of middle-aged men will be out of work at any given moment.” Indeed, the Bureau of Labor Statistics has predicted that by 2022 the amount of manufacturing jobs in the U.S. will drop. However, manufacturing in the United States will increase.

How the shale oil revolution is contributing to the re-emergence of the United States in manufacturing.

Besides automation, the oil boom in the U.S. has decreased costs significantly in the U.S. versus China. While China still depends on electricity generated by coal, which is expensive, the U.S. access to electricity generated by natural gas has lowered the cost of the purchase of electricity by 30 to 50 percent using natural gas to generate electricity.

The theory that increased costs of a competitor and increased prices can increase domestic manufacturing can be validated with the empirical evidence of the oil shale boom in the aughts of the 21st century. The sharp increase in the price of a barrel of oil in the early part of this century led to the exploitation of the vast shale oil fields in the Permian Basin in West Texas. With the cost of a barrel of oil in 2008 reaching $140 a barrel, it became profitable for the capital investment necessary to exploit the rich shale oil fields. Once the original investments (also known as sunk costs) had been made, and profits began to be made, new technological improvements to the fracking process made shale oil more commercially viable, putting a ceiling over the cost of a barrel of oil on the world market. This is also true of the advent of the increasing use of automation and robotics to manufacture goods.

How steady-state growth versus non-steady state growth will impact the trade balance.

Given China’s political structure, where there is no independent judiciary that can adjudicate contract disputes according to fixed law, the Chinese economy is fixated in “steady-state growth” aka stationary growth. The wealth of a nation can increase only if land and capital help to increase production faster than the labor force.

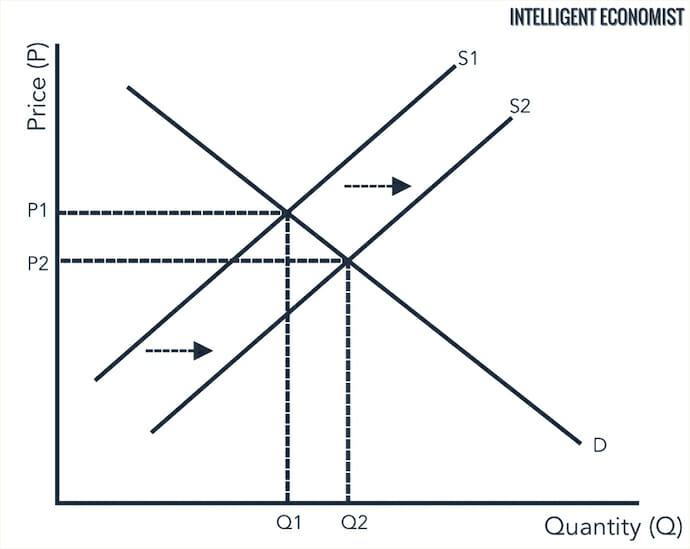

The economy of the United States is based on a “non-steady state growth” model which is based on the Nobel prize-winning theory the “Solow-Swan theory.” Simply explained, the U.S., with an independent judiciary that can adjudicate contract law by a disinterested third party, is able to use technological breakthroughs to achieve non-steady state growth. Technological breakthroughs deliver increased production of goods while lowering production costs. This growth, due to technological change, pushes the aggregate supply (AS) curve to the right in a Cartesian economic graph. Because the aggregate demand (AD) curve is tied to the AS curve, the AD curve moves to the right as well in a downward trajectory. This graph visually shows the increase in production at a lower cost and an increasing demand for that good.

In the above graph, we see an increase or upward shift in the supply curve from S1 to S2. The result of this increase in supply while demand remains constant is that the supply and demand equilibrium shifts from price P1 to P2 and quantity demanded and supplied increases from Q1 to Q2.

In the above graph, we see an increase or upward shift in the supply curve from S1 to S2. The result of this increase in supply while demand remains constant is that the supply and demand equilibrium shifts from price P1 to P2 and quantity demanded and supplied increases from Q1 to Q2.

The steady-state growth model and the non-steady state growth model can also be explained with the production function equation for both models.

Steady-State Growth and Non-Steady Stage Growth Equations

The production function for steady-state growth can be explained with this simple equation: Land + Capital + Labor.

Steady-state growth depends on additional inputs of either of these items in the production function. To increase growth, it is necessary to increase one of these inputs. Witness the seizure of the South China Sea by China to obtain additional inputs and land to maintain its economic growth.

The production function for non-steady state growth can be expressed with a slight variation of the production function with the addition of technological change. To account for technological inputs, we will add the symbol Ct to the production function as a subset of the capital function: Land + Capital(Ct) + Labor.

The addition of technology to the production function allows for a steady-state growth rate to transform into a non-steady state growth rate until the law of diminishing returns eventually returns the affected economy back to steady-state growth.

Conclusions

While derided worldwide, the Trump administration’s use of tariffs has affected the Chinese economic growth model to where the Chinese economy is slowing and has led to a decrease in manufacturing. It has reached a point where the Chinese government is subsidizing rents for foreign companies to remain in China.

This decrease is carrying over into the overall Chinese economy, which in turn has affected tourism in SE Asia.

In contrast, U.S. steel manufacturing increased in June of 2019 from 7,276 tons to 7,514 thousand tons. Since June however, steel production in the U.S. has declined as the retaliatory tariffs on steel imposed by the Trump administration on other countries other than China has begun to hit the U.S. economy. Nonetheless, U.S. manufacturing increased in July of 2019, and a study by Microsoft shows that automation users will increase spending to $6.1 billion in 2020 up from $5.1 billion in 2016. In addition, the cost of sensors has dropped by 200 percent from 2004 to 2018 as demand for automation by U.S. manufacturers continues to grow and economies of scale come into play.

With the technological edge of U.S. companies beginning to increase due to automation, robotics and the lower cost of energy in the U.S. mainland, the trend of increasing Chinese manufacturing in the world will reverse and be changed in favor of the U.S.

It remains to be seen if the Trump administration will continue its course of retaliating against the aggressive use of Chinese theft of intellectual property rights against Western companies. If the Trump administration caves to current political pressure, the technological advantage enjoyed by the U.S. will soon fade, and again the U.S. will find itself in a disadvantageous trading position. If the Trump administration holds its current course, then the deteriorating economic conditions will force China to adhere to the rules governing the rights of intellectual property. Failing that, the Chinese will be forced to add inputs into its production function and that course will be one fraught with danger and high costs which might lead to the fall of the CCP.