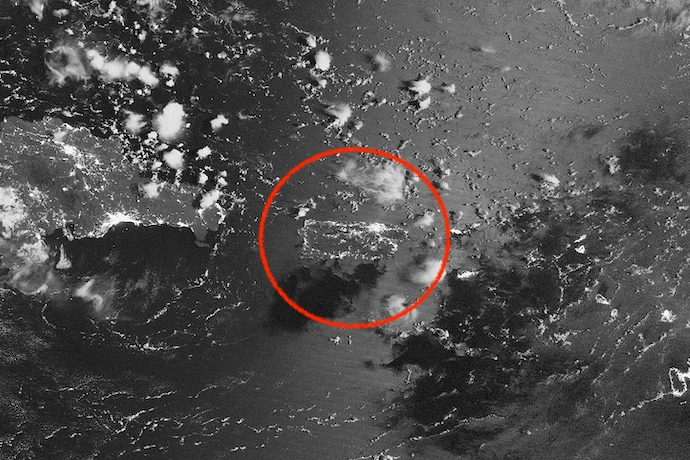

Puerto Rico’s Blackout and National Resilience

While electricity will eventually return to Puerto Rico following a massive island-wide blackout that left 1.5 million residents in darkness, it may take decades for the island to return to a solid footing. The confluence of unfortunate events that negatively impacted the U.S. territory are of both acute and attritional variety. The blackout, however, is an entirely predictable outcome resulting from decades of mismanagement and under-investment in the backbone of a modern economy – namely the electricity grid. In short, bad things happen in the dark.

Not only are Puerto Ricans suffering from extortionately high energy costs averaging between 4-6 times higher than the U.S. mainland, their comparatively low GDP per capita under $20,000 compared to $52,000, makes the blackout a painful punctuation mark in an otherwise cruel joke. The resilient Puerto Ricans remained calm in the face of another setback and many took a fiesta.

At the center of this joke is the island’s sclerotic and bankrupt public utility, PREPA. Anywhere else in the world, there would be a serious movement towards privatization or some hybrid public-private model to electrification and distribution, which in Puerto Rico’s case would also ease the burden on the public balance sheet. In Puerto Rico, whose financial matters are now in the hands of a Federally-appointed financial control board, this type of bold move may prove politically risky for the board and the island’s elected officials and unpalatable to an otherwise paralyzed Washington griped by a farcical presidential race and bitter partisanship.

The island is at once ground-zero for the U.S. municipal debt crisis, with an eye-watering $73 billion in public debt, the Zika virus, which has affected 1 in 5 Puerto Ricans and crippled its tourism industry, and, with this blackout, an emblem of America’s poor infrastructure scorecard and lack of resilience. All of these crises pose a real risk of contagion to the broader safety and security of the U.S. The Zika-carrying aedes aegypti mosquito, like financial contagion to the municipal bond market and the broader economy, do not respect borders. In fact, the Centers for Disease Control and Prevention (CDC) issued an unprecedented travel warning in the contiguous U.S. to avoid travel to parts of Florida. It should be of no comfort that the endemic aedes aegypti mosquito plays host to dengue, yellow fever, and chikunkunya, among other vector-borne diseases whose inexorable march north is fueled by globalization and climate change.

The blackout in Puerto Rico, like the forgotten water crisis in Flint, Michigan, is emblematic of the broader deterioration of critical infrastructure in the U.S. The lack of long-range focus and an investment strategy that goes beyond maintenance and Band-Aid fixes and aims for broad infrastructure modernization is the only way to build a resilient country – one that does not buckle under the strain of normal use or modern commerce and collapse in the face of wide-ranging threats from cyber risk, tree-branches, and acts of nature.

Puerto Rico, like Flint, Detroit, New Orleans, Baton Rouge, and other forgotten American communities need not strain public finance and goodwill. Rather these great cities and territories are perfect proving grounds for building a resilient national future. The costliest of interventions, like with the medical system or sending the military to combat Ebola, are when uninsured patients arrive in an emergency room. Instead of letting our fellow citizens fall through the cracks in our poorest and most vulnerable communities, we have an opportunity and an obligation as one nation to meaningfully invest and pilot new approaches to thriving and surviving in increasingly turbulent times.

Some long-forgotten tools in our tool kit, which we were prepared to leverage to wage wars and rebuild Europe, include the issuance of national infrastructure bonds creating an investment horizon long enough to remove, rebuild and retrofit critical infrastructure.

In Puerto Rico’s case, immediately lifting the Merchant Marine or Jones Act, would enable alternative energy sources, such as propane and liquefied natural gas (LNG), along with all others goods to be imported to the island with more competitive landed costs. Customers of companies like Tropigas, a local propane, and energy efficiency firm, were among the only ones with their lights on thanks to residential and industrial-scale generation equipment and an island-wide distribution network. While getting off the energy grid entirely is not the answer, having viable cogeneration alternatives will not only create redundancy, it will help ease the burden on an aging and inefficient system. Critically, lest Puerto Rico loses its industrial base like it is losing its middle class, cogeneration is a solution to keeping hotels, pharmaceutical, and industrial firms on the island with reliable, redundant, and cost-effective energy.

The risk of large-scale blackouts has grown increasingly likely with the advent of sophisticated cyber-attacks against energy infrastructure. Lloyd’s, the world’s specialist insurance market, estimates that a cyber-attack against the U.S. energy grid would cost the economy between$243 billion and $1 trillion depending on the severity of the attack. On a lower scale, the 2003 Great Blackout exacted a heavy toll on the U.S. estimated at $8.2 billion, crippling the country’s financial center, New York, and demonstrating that cities are increasingly in the cross-hairs of unpredictable risks. It is widely accepted that risks are to be avoided. Resilience on the other hand is something we can accurately measure, plan for and invest in. Puerto Rico’s blackout, like our other forgotten crises, remind us that it is time to act.