Estimating the Cost($) of Freedom

There has been a considerable discussion about the dangers of national debt in many countries in the wake of the 2008 financial crises. This concern has prompted a move toward austerity in many countries (the European Union) and squabbling over inaction on the debt in others (the United States). However, looking at the map, one gets a sense that the really dark red areas aren’t randomly distributed.

There is a curious paucity of high-debt countries in Africa, for example. Countries with more liberal policies (the European Union, North America) appear to be saddled with debt. In fact, countries in the most stable parts of the world seem to have the most debt. The good news is that it is data and can be tested. To test this, Freedom House rankings were used. Each year folks over at Freedom House rank countries on civil and personal liberties. Each country receives a grade of Free, Partially Free, or Not Free each year. Its data is freely accessible here.

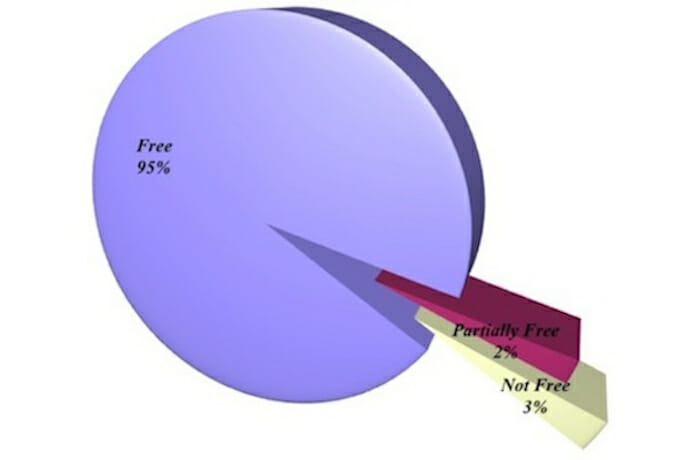

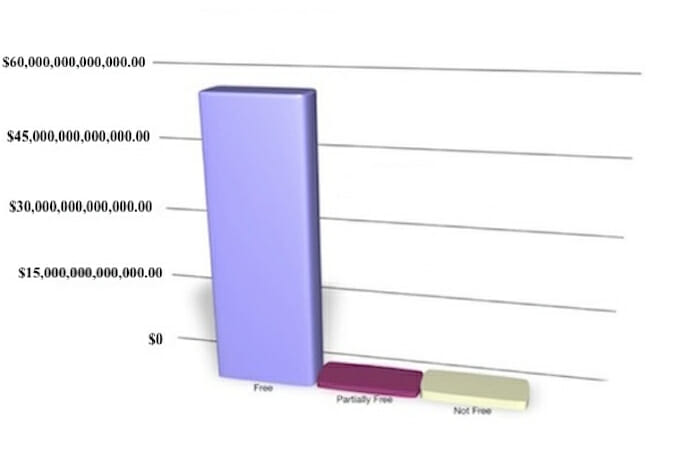

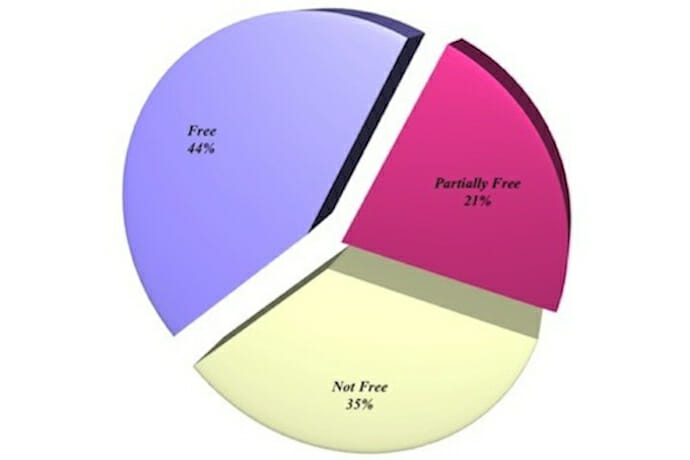

Data on the national debt load of each country and their population was pulled from Wikipedia. To get a frame of reference, let’s look at the percentage of folks who live in Free, Partially Free, and Not Free countries.

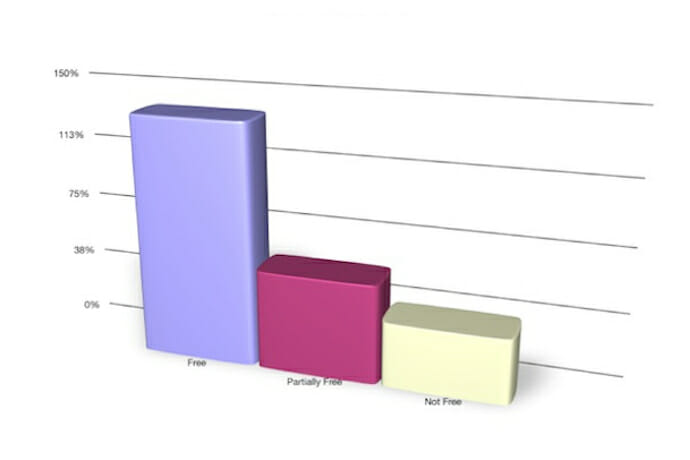

Less than half of the world’s population lives in a free state. Less than a quarter lives with some level of freedom, and over a third lives without. Now, if debt were distributed equally without regard to freedom, we should expect 44% of the total world debt to be owed by free countries. Picture that graph in your mind. Got it? Let’s look at the reality.

All graphs provided by the author.

However free countries are not fond of paying high taxes in exchange for these government services. In fact, no one is really a fan of paying high taxes. Being free and all, they have their choice in leadership. Elected leaders that manage to remain elected leaders deliver good services with low taxes by leveraging their respective country’s debt. Now then, who owns all this debt?

Let’s use the United States as an example. The US has a debt-to-GDP ratio of 99%, above average for free countries but not the highest by a long shot. The average US citizen owes about $47,568. National debt for the US is sold as treasuries, which people invest in. State governments frequently hold the retirement funds of their employees in US Treasuries. About $40 billion of famed investor Warren Buffet’s estimated $47 billion fortune is held in US Treasuries. If you have a mutual fund, you may have a little of the US National Debt yourself. In fact, the national debt of Free Countries can be characterized as a system where the 1% (in Occupy-Wall-Street language) earns interest on government social welfare programs for the other 99%.

For those conservatives who value fiscal austerity above all else, there are countries to look to for inspiration. For example, Iran has a debt-to-GDP ratio of 4%. Iranian citizens owe only $170 on their country’s debt. Libya under Muammar Gadaffi’s was fiscally sound, it had a debt-to-GDP ratio of 9%, with each citizen owing $972. North Korea very possibly has no debt whatsoever. These are national debt numbers that US Republicans and British Tories can only dream of. It may only require a reduction in the freedom of citizens. In fact, we can pretty directly quantify that cost of freedom by looking at the debt owed by individuals in Free, Partially Free, and Not Free countries. Freedom isn’t free, but you can always take out another loan.