Biden Announces New Tariffs on Chinese Goods. What’s Next for China?

Since 2018, the U.S.-China trade war, initiated during the Trump presidency, has aimed at readjusting trade imbalances and reducing reliance on Chinese manufacturing. The lingering questions remain: can the U.S. successfully decouple from China, and which markets could benefit the most from this shift? In what may be his final year as president, Joe Biden has given a new direction to Sino-American relations.

The trade deficit experienced notable fluctuations post-2018, initially declining to $342.63 billion in 2019, likely influenced by the onset of trade war measures, particularly the increase in tariffs on selected imported goods from China. The deficit further decreased to $307.97 billion in 2020, coinciding with global trade disruptions caused by the pandemic, and sharply dropped to $279.42 billion in 2023. These numbers indicate that the series of measures to decouple from China have been effective. So now, what’s next for China?

The current state of the Chinese economy, severely impacted by the pandemic, has led American companies to reconsider their China strategy and explore other markets. Mexico and Southeast Asian countries are poised to benefit from this shift. Vietnam and Thailand have already become major beneficiaries of the U.S.-China trade war, attracting significant foreign direct investment as companies seek to relocate their manufacturing operations. For instance, Thailand saw foreign direct investment reach $18.6 billion last year, a 72% increase in value compared to 2022.

Mexico has also benefited from its proximity to the U.S. In response to the uncertainties arising from the U.S.-China trade war, Stanley Black & Decker closed a power tool factory in Shenzhen, China, shifting some of its manufacturing operations to Mexico.

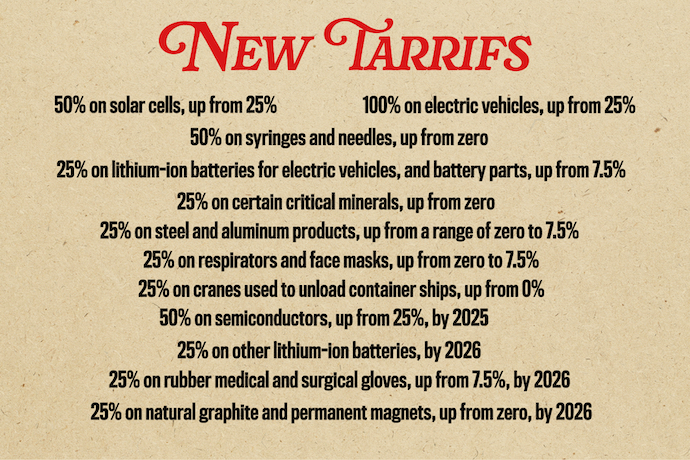

The newly announced revised tariffs on imports of Chinese goods under Section 301 of the Trade Act of 1974 could have significant impacts on both the U.S. and China. Some tariffs now reach as high as 100%, affecting $18 billion worth of Chinese imports. Given that China now accounts for over 60% of all global EV sales, the EV industry might suffer the most from these imposed tariffs. This is compounded by the European Union’s scrutiny of the Chinese EV industry, with the European Commission initiating an investigation into three Chinese EV car manufacturers over state subsidies, which may explain their lower prices compared to European manufacturers.

This news comes amid efforts by BYD, China’s most prominent EV company, to invest in a new energy vehicle manufacturing factory in Hungary in the coming years. Despite losing significant market share and initiating a series of layoffs, Elon Musk visited China in late April to lobby for Tesla’s autonomous driving technology.

The new tariffs on imports of Chinese goods announced by Biden are:

As China moves towards becoming an innovation-driven economy, the Biden administration has targeted two major industries where China is thriving: microchips and electric vehicles. It is worth mentioning that the current discussions of banning ByteDance’s TikTok in the U.S. are also part of Biden’s containment policy. TikTok, however, is the cherry on the ice cream. The company is at risk of losing its 102.3 million monthly active users in the U.S. due to arguments that the Chinese Communist Party, under national security laws, can access its user information. But politics, protectionism over American companies, and, of course, the trade imbalance also play important roles in this decision.

With the option of selling TikTok, ByteDance will most likely give up its business in the U.S. American social media and search engines like Google and Meta have long struggled to penetrate the Chinese market. Therefore, TikTok’s case can be seen as a payoff for their years-long struggle.

China may soon announce retaliation to the new tariffs, but a reconfiguration of China’s relations with both the U.S. and Europe is necessary. Regarding the tariff increase, Chinese Foreign Minister Wang Yi has said, “This is the most typical form of bullying in the world today. It shows that some people in the United States have reached the point of losing their minds in order to maintain their unipolar hegemony.”

Chinese President Xi Jinping recently concluded a five-day tour to France, Serbia, and Hungary, while reportedly Joe Biden’s last call with President Xi happened on April 2.

The tensions between China and the U.S. reflect broader economic shifts under a new definition of strategic partnership. With its emphasis on innovation and technological advancement, China could look towards emerging economies in Africa, Southeast Asia, and the Middle East to expand its presence and forge new trade alliances, while Latin America may pose challenges due to the natural relations of some countries with the U.S. The U.S., on the other hand, will enhance its cooperation with allies, shifting manufacturing efforts to emerging markets, which now have the advantage of being more cost-effective than China.

China is confronted with a daunting challenge, as it faces the risk of diminishing its role as the world’s manufacturing hub. The country needs to redefine its foreign affairs strategy amidst growing animosities with the U.S., Europe, India, and Australia if it aims to uphold its significance in the global economy.