Don’t Buy into China’s Rhetoric

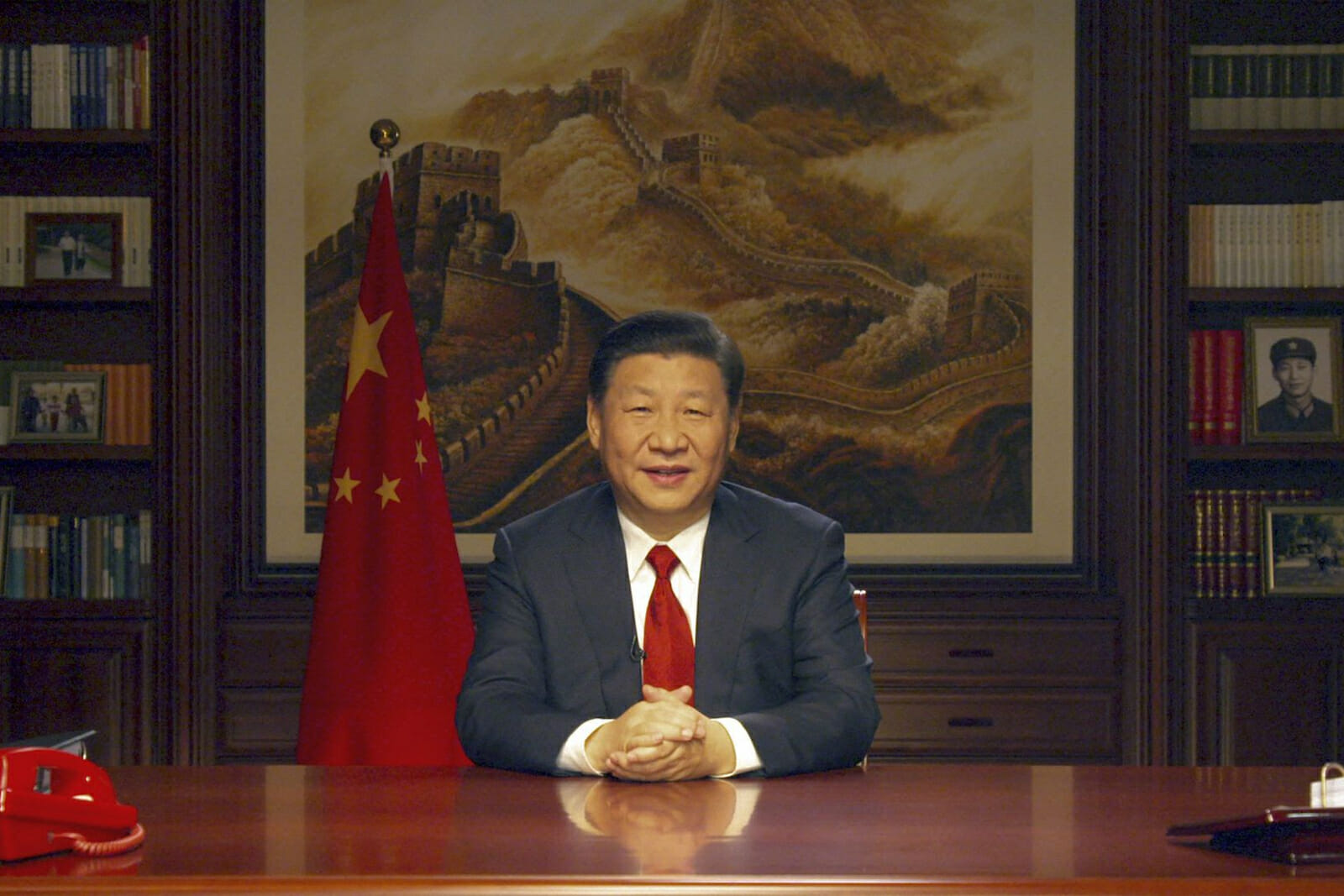

What makes Belt & Road so significant? Americans think it is. President Trump reportedly calls it an insult. Secretary of State Mike Pompeo issues warnings about it. Secretary of Defense James Mattis compares it to a form of dictate in various regions. All are contributing to the grandeur of China’s Belt and Road Initiative (BRI).

Touted as a development strategy to enhance multi-regional connectivity, BRI sees China pour its money into infrastructure projects along the original Silk Road route through Asia and Europe, and also the 21st Century Maritime Silk Road connecting China with the Indian Ocean and North Africa.

The initiative has been included in China’s Party Constitution and got several financial institutions like the Asian Infrastructure Investment Bank or its own Silk Road Fund to back its projects. Indeed, it sounds huge. But it isn’t, really. Look at its members, actual projects and China itself, and you’ll see a smaller BRI scope.

First, member wise. Although China in 2018 announced more than 100 countries and international organizations had signed Belt and Road cooperation documents, many of these countries are not wholeheartedly participating in BRI as advertised. Some, including South Korea, Austria and the Czech Republic, haven’t invested. India and its Kolkata region are listed under the BRI map even though Indian Prime Minister outright opposed the initiative.

Many took actions, but distanced themselves from BRI at the same time. Vietnam only signed an MOU in 2017 supporting BRI while emphasizing its previously implemented economic plan with China (coincidentally called “Two Corridors and One Belt”), indicating they are two different plans. Russian president Vladimir Putin publicly endorsed BRI at a 2017 summit but stressed its own Eurasian Economic Union. Thailand, despite its public support of BRI, in 2018 laid down a plan with other Mekong countries to create a separate regional infrastructure fund as an alternative. One simple reason: they have all been cautious since the very start.

Second, project wise. Lots of obstacles are slowing down the progress. BRI has been slowly making an impact on the ground but many mega projects have been delayed or are behind schedule like the $8.2 billion railway in Pakistan or the $6 billion railway in Indonesia. In Malaysia, the $20 billion rail link and $2 billion-plus gas pipe line, have been cancelled. The dam project in Nepal was reported to be canceled. Myanmar is still reviewing a port project over debt concerns. The trend is likely to go on with rising concerns over trade practices (Sri Lanka’s debt trap), national security (new kind of colonialism in Africa), social impact (with projects requiring Chinese or Chinese speaking laborers in the receiving countries) or environmental damage, etc.

Moreover, China is known to exaggerate its own projects. For another initiative, its Melong–Lancang Commission, China merged the projects that are already underway into its scope to make it look bigger. According to CSIS, with BRI, China employed the same practice by counting already started projects into BRI (and renaming them to make it more legitimate). The Economic Corridor between China and Pakistan, for example, started in 2013, before BRI was officially announced, is now considered a part of BRI. For the same reason, Vietnam has implicitly tried to signal that the China-invested sky-train project in Hanoi is separate from BRI.

Third, resource wise. China has its own struggles to live up to BRI’s “size.” It is estimated China will invest between $1 and $8 trillion. However, its economy is growing at much slower rate these days. That tendency to decelerate is expected to continue after 2019.

Additionally, with BRI targeting mostly developing nations with low economic conditionality, China’s private businesses would consider it risky, hence they’re less tempted to invest, placing the financial responsibility on the public sector. In fact, 90 percent of the funding has been reported to come from the public sector. That will subsequently create more weight on the Chinese government.

A recent report by AEI concluded that China’s state-owned enterprises will not be able to afford paying for construction projects, which are what most of BRI projects are about, especially with its decreasing foreign reserves, and BRI will not hit $1 trillion in value until well into the 2020s.

Implication for the U.S.

It’s only reasonable for the U.S. to worry about BRI, considering its strategic implications, China’s economic practice and its growing impact. But the danger of over-worrying is to make it the top concern, and thus give BRI a status it hasn’t earned.

This might as well be the aim of China’s propaganda all along. And it seems key figures in Donald Trump’s administration are taking the bait. Instead of overestimating BRI, American officials could use their platforms to shed more light on the actual limits in BRI’s scope in terms of its participating nations, its projects on the ground and China’s resources.