Prime Broker vs. Traditional Brokers: The Regulatory Gaps in Global Markets

When making investments, it is important to understand the difference between prime brokers vs. traditional brokers.

Regarding trading, brokers are essential in ensuring easy transactions and providing access to the individuals involved. They act as intermediaries between buyers and sellers, ensuring individuals and companies take part in global financial markets.

There are generally two types of brokers—prime and traditional brokers—and each plays a different role in the financial market. In this article, we will discuss the differences between each broker and how they are regulated.

When analyzing prime brokers vs. traditional brokers, it is important to examine their roles, regulatory gaps in global financial regulations, and how they impact market stability, investor protection, and risk management.

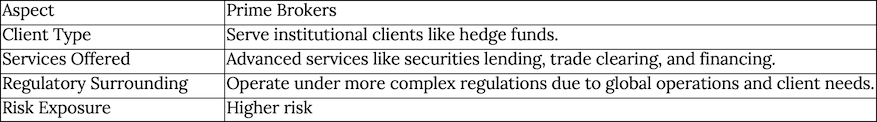

A prime broker is a financial institution that coordinates intricate investment and trading systems. These institutions include large investment banks and firms like Merrill Lynch and Goldman Sachs. Prime brokers like these offer prime brokerage services to large investment clients, such as hedge funds.

Traditional brokers, on the other hand, serve individual investors or smaller businesses, offering individualistic services including investment advice, portfolio management, and research. Also known as full-service brokers, they focus on helping clients meet their financial goals while adhering to financial standards.

The difference between prime and traditional brokers regarding regulatory gaps primarily lies in their compliance obligations’ scope, complexity, and focus.

Due to the nature of their clients, prime brokers operate in a very complex regulatory environment. As a result, they have to keep up with stringent rules across various jurisdictions, including capital adequacy, client asset protection, and transaction reporting. For example, regulations like the Dodd-Frank Wall Street Reform and Consumer Protection Act impose higher capital requirements, enhanced risk management practices, and stricter due diligence on prime brokers.

Prime brokers frequently assist institutional clients, such as hedge funds, in fulfilling regulatory obligations. This involves providing comprehensive reports, necessary disclosures, and guidance on compliance with regulations like anti-money laundering and other legal requirements.

When operations are complex, gaps can still occur even in the presence of stringent requirements. A common example is when inadequate monitoring systems lead to vulnerabilities such as freeriding or misuse of client funds.

Traditional brokers usually work with retail or smaller-scale clients and operate under less complicated regulations compared to prime brokers. Their main goal is to help clients follow financial standards that protect them from fraud.

Regulations for traditional brokers emphasize safeguarding retail investors through measures like transparency in fees, suitability assessments for investment recommendations, and fraud prevention.

Since traditional brokers do not engage in high-leverage or complex institutional activities like securities lending or derivatives trading at the same scale as prime brokers, their regulatory risks are generally lower.

When you learn about the different types of brokers, you will be better informed as a trader and able to choose the one that suits your trading needs.