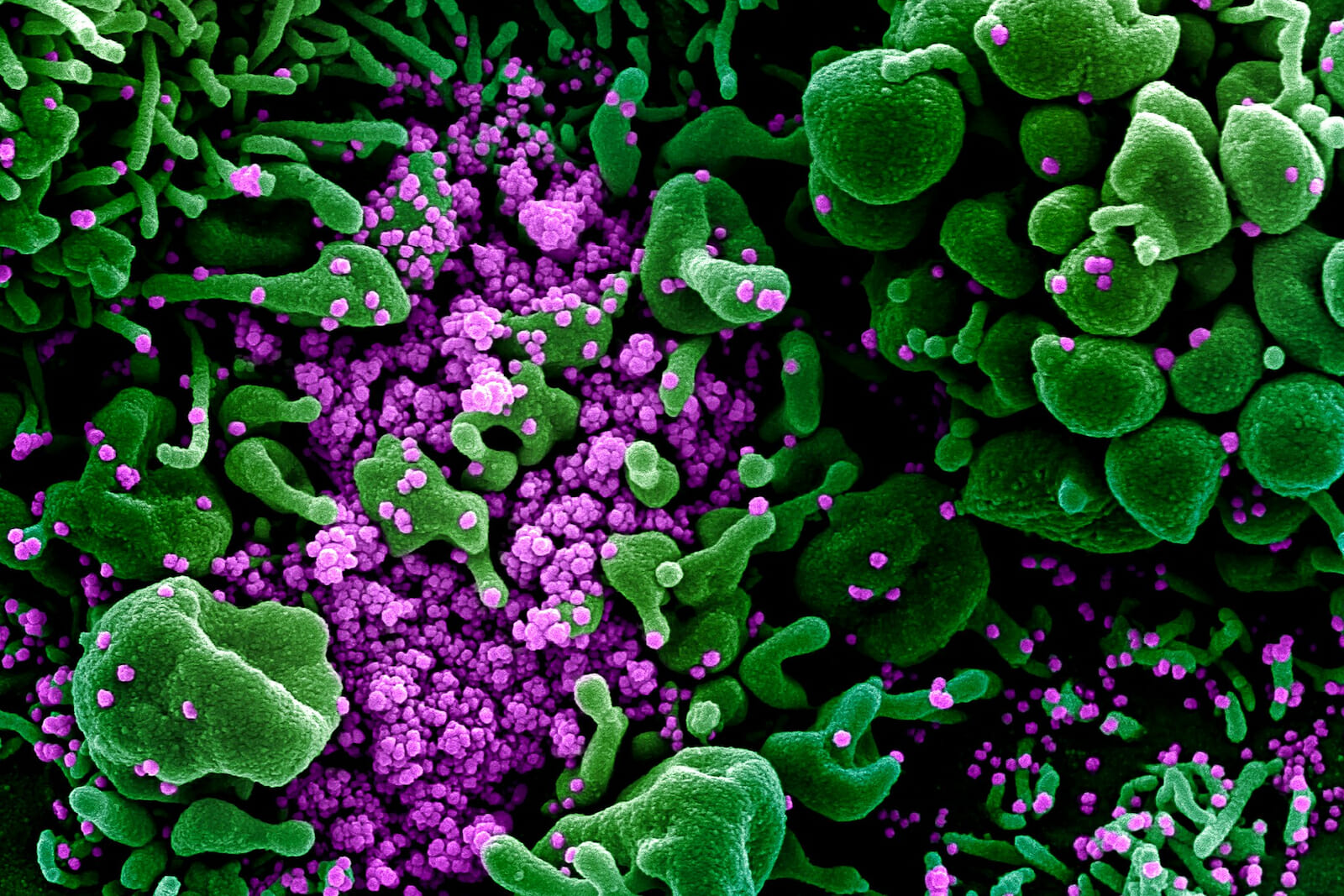

The Need for Pandemic Risk Sharing

It is likely that the spread of COVID-19 and the consequent global response will be used as a case study in black swan events with large economic and societal impacts. Across systemic risks, including pandemics, predictive modeling, and historic data will continue to improve how we quantify local or even global economic losses. In response to mandated quarantines and disruptions across the value chain, legislatures have spent unprecedented sums to safeguard the economy.

Much like in the case of cybersecurity, this event will likely drive the purchase of new insurance products, backed by innovative brokers and insurers. While it is impossible to buy insurance for a burning house, organizations have already begun to prepare for the next pandemic. Marsh, a leading insurance broker, for instance, has said there is renewed interest around its PathogenRX program underwritten by Munich Re.

According to the same report, Gunther Kraut, who is the head of epidemic risks at Munich Re, says: “The impact of the coronavirus provides clear evidence that there is a need for this kind of risk mitigation solution to enhance the economic resilience of company balance sheets.” Further, the evolution of pandemic risk touches a number of different coverage areas. From business interruption, directors & officers’ liability, life & health, and even reputational risk, organizations likely have no stand-alone solution and will need to depend on a liberal interpretation of their coverage across policies.

Given the current state of organizational coverage, it is clear that the protection of small and medium businesses will be underwritten by the public sector. The impact being that the political precedent set by the scale of the government’s response will shape the public’s expectations for intervention in future downturns. This is especially true in a low-inflation world where fiscal measures will have to supplement the marginal effects of dovish monetary policy. The future strain on the public purse strings to mitigate future losses will require governments to become innovative and shift their dependence on taxpayers into the private sector. Public risk-sharing for systemic risks is not a novel concept and has been talked about extensively by entrepreneurs and thought leaders in different risk domains.

In the last five years, Dante Disparte, Chairman of the DC-based brokerage Risk Cooperative, has championed this approach in the realm of cybersecurity. According to Disparte, pandemic like risks will “create a raft of unfunded losses passed onto taxpayers or other parties…making the government the insurer of last resort rather than the first line of defense.” Organizations like Risk Cooperative have in turn designed taxpayer deductible schemes that limit public losses which could be equally applied to a pandemic scenario. More importantly, an adoption of these programs at a local level would ease the need for further federal assistance and provide businesses the flexibility to retain employees and assure stakeholders. Government assistance during the COVID-19 spread has been focused on creating liquidity and making cash available to organizations. According to the Economist, small companies in the United States don’t currently hold enough cash to get through a month of expenses.

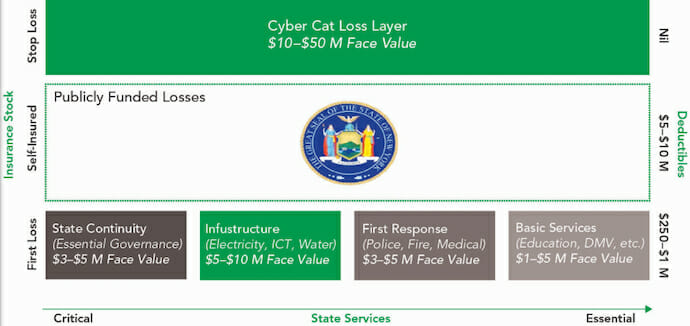

The diagram below shows Risk Cooperative’s cyber catastrophic loss scheme at the state-level. The program envisions a first line of coverage acting as a deductible to publicly funded losses; after which a catastrophic loss layer sits in excess of what the government is “self-insuring.” National resilience amid pandemic risks rests on the ability for private insurers to develop relationships with government entities. These relationships will not only provide an added level of security for the future spread of contagions, but will serve to protect taxpayers, businesses, and strengthen local government.