The Platform

Latest Articles

by James Carlini

by Muhammad Zain Ul Abdin

by Ismaila Biliaminu Manne

by Ismaila Biliaminu Manne

by Arth Agarwal

by Sohail Mahmood

by Sehr Rushmeen

by Iqra Awan

by Areesha Anwer

by Abdul Mussawer Safi

by James Carlini

by Muhammad Zain Ul Abdin

by Ismaila Biliaminu Manne

by Ismaila Biliaminu Manne

by Arth Agarwal

by Sohail Mahmood

by Sehr Rushmeen

by Iqra Awan

by Areesha Anwer

by Abdul Mussawer Safi

Future of Finance and Banking in Africa Post-Pandemic

As the pandemic ravaged the global economy, governments introduced containment measures in the form of border closures and lockdowns, effectively restricting movements across borders and within countries to only frontline and essential workers. Non-essential services and high-contact economic activities were grounded, resulting in massive economic losses. A study by Australian National University suggests that the global economy could potentially lose up to $21.8 trillion in 2020 alone, due to the pandemic. Correspondingly, the African Development Bank projected that Africa, in 2020, is expected to suffer GDP losses of between $145.5 billion and $189.7 billion.

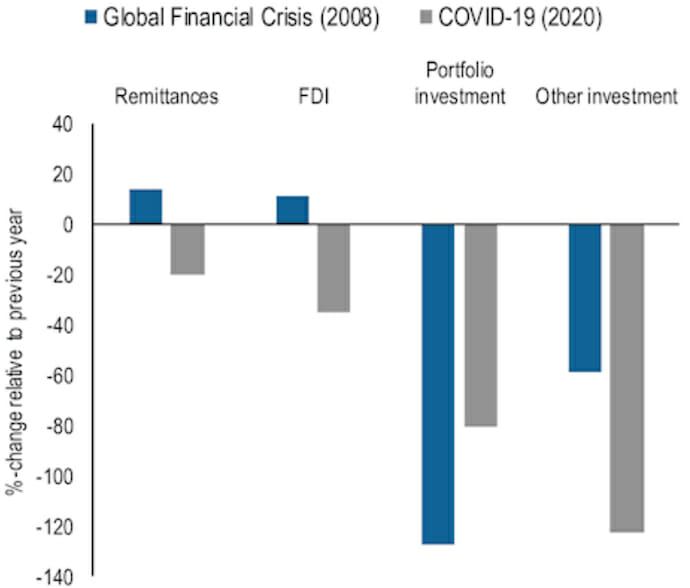

Policymakers are concerned that what started as a health crisis could potentially snowball into a financial crisis. A report by the IMF, argues that due to COVID-19, many emerging markets and developing economies are facing sharp declines in export demand and commodity prices, large capital outflows, foreign exchange shortages, and increasing debt burdens. McKinsey & Company suggests a fall in African banking revenue of between 23 to 33 percent from 2019 to 2021 and a dip of 5 to 15 percentage points in return on equity over the same period.

With a decline in income and revenue, the financial and banking systems in Africa will be threatened by the increased volume of non-performing loans, resulting in the deterioration of asset quality, leading to a heightened level of precautionary lending and a credit crunch. There is also the loss of margin due to accelerated digitalization from operators within the financial technology (fintech) space and technology adoption by customers, forcing banks to adapt to changing business environment.

The future of finance and banking systems in Africa post-COVID would rely on the ability of the system to effectively manage risk and capital in the event of future systemic shock, streamline resources, adapt to shifts in consumer behaviour as it affects digitalization, and of course, live with re-tightening of regulation. Financial sector operator and governments should consider the following strategic responses:

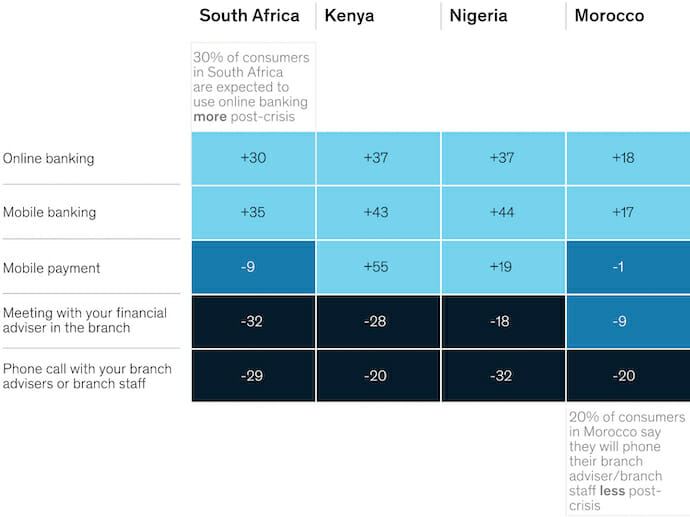

1. Technology adoption and response to shifts in consumer behaviour

African finance and banking systems should leverage the use of technology to reduce costs and enhance innovation. This could be achieved through the adoption of digital-only banks such as “cloud-based banking.” Deloitte recommends cloud-based banking as the future of banking since it allows firms to store data and applications and access advanced software applications via the Internet. Efforts should be intensified to adopt digitalization due to increased competition from payment service providers, and fintech companies reducing bank’s margin by providing retail and wholesale banking.

2. Increased efficiency in risk and resource management

To reduce the incidence of delinquent loans, financial sector operators should increase the level of risk assessment. Credit risk management could mean the tightening of underwriting standards or foregoing certain types of lending altogether. With Deloitte Consulting increased digitalization, operational risk should focus more on cybersecurity and protection of customer data, while agency banking should be aggressively explored to widen access and increase margin for financial sector operators.

3. Increased capitalization and regulatory tightening

The spare capacity and buffers that banks built up after the global financial crisis have been eroded by financial institution’s response to the pandemic. Additionally, given that governments are hard-pressed for funds, policy response in the form of regulatory forbearance would be reversed, leading to regulatory tightening and mandatory capitalisation. The resultant effect is an increased pressure on banks to shore up their capital base. The outlook is that banks that are unable to individually increase their capital base would either be acquired or be forced to merge with others.

4. Potential increase in private finance, non-bank financial institutions, and strategic acquisitions

With interest rates in Europe and North America approaching the zero lower bound, Africa appears to be the preferred investment destination for private finance post-COVID. The participation of non-bank financial institutions such as insurance companies, pension funds, endowment funds, sovereign wealth funds, and alternative asset managers is expected to increase. Similarly, financial sector operators would involve themselves in strategic alliances and partnerships that could culminate into acquisitions.

5. Avoidance of the crowding-out phenomenon via resource-backed lending

The fiscal constraints triggered by the pandemic could potentially push governments to raise funds from capital markets as a way of financing budget deficits, thus, crowding out private investment. However, resource-rich African countries could avoid this trap by exploring collateralised debt financing options such as resource-backed lending. The benefit of resource-backed loans is that they provide opportunities for the funding of infrastructure and other development projects for countries with limited access to credit or capital markets.

6. Promote fiscal consolidation by increasing the tax base through luxury tax

To reduce the level of government fiscal deficit exacerbated by the pandemic and conversely increase sources of government revenue, governments across the continent should expand the tax base through tax reforms. The reform would include the imposition of luxury tax via legislation. The political economy of luxury tax, notwithstanding, it is a pro-poor, fair and welfare-enhancing means of financing government expenditure without compromising fiscal consolidation.

Though COVID has led to greater financial fragility amongst African countries and other economies in the global south, we expect that with the right policies, the African banking and financial systems would emerge from the pandemic more resilient and strengthened to support medium to long-term economic growth.

Chika Onyeukwu is an Economist, Financial Analyst, Performance Manager, Corporate Governance and Strategic Planning expert. He holds a Master of Science degree in Economics and a first-class honors Bachelor of Science degree in Economics and Statistics. His interest is in global economics and politics but he has a strong passion for the development of Africa.