China, Rare Earth Minerals, and Nuclear Options

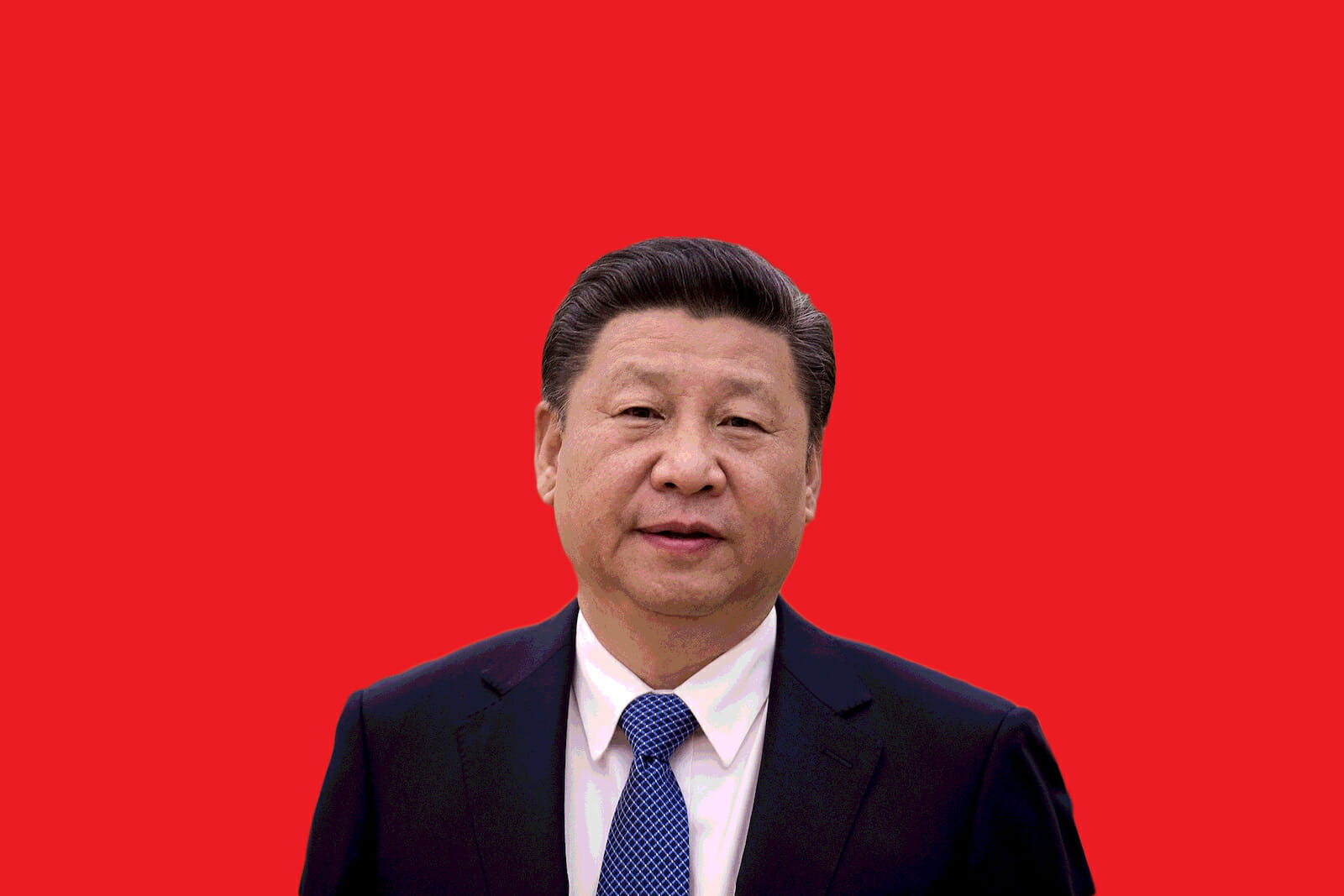

In 2010, China ceased exporting rare earth minerals (REMs) to Japan. Despite strangely coincidental timing, Beijing said at the time that its action should not be perceived as retaliation for its dispute with Tokyo over ownership of the Senkaku Islands or Japan’s then detention of the captain of a Chinese fishing boat. Beijing argued that it had, after all, also suspended its exports of REMs to the US and Europe, and had been steadily reducing its export of REMs since 2005.

It should therefore surprise no one that Beijing is reportedly considering restricting the export of REMs to the US, ostensibly in reaction to the escalating bilateral trade war. Doing so would be one of two “nuclear” options Beijing has at its disposal. The other would be to stop purchasing US treasuries (Beijing being their largest foreign purchaser, with Tokyo being a close second) or pick up the pace of selling US treasuries (which Beijing has been doing since 2013).

China produces approximately 80% of the world’s known REM supply, although only about a third of the world’s reserves are located there. The Chinese government claims it possesses less than 20 years-worth of medium and heavy minerals and must reduce its export of REMs to preserve its supply. Given that a minimum of 3 to 5 years are generally required to make new mines operational, additional alternative sources of REMs remain years away. Since 2010, a number of countries (Japan among them) have replaced Chinese-sourced REMs with that of other countries, such as Australia, Brazil, India, and Russia.

The US was, from the 1960s through to the 1980s, the world’s number one producer of REMs, sourced from the Mountain Pass mine in California, which was subsequently closed due to environmental issues associated with the disposal of toxic wastewater and an inability to compete with lower cost Chinese mines, which were not required to comply with the same degree of environmental restrictions. The mine was reopened in 2017 and now produces as much as 10 percent of global supply, but it remains dependent on China for ore processing. The US General Accountability Office calculated almost a decade ago that it would take up to 15 years for a domestic REM industry sufficient to meet America’s needs to be re-established.

The fact that REMs are in limited supply and used to produce a wide array of products that are either in high demand, critical to green technology or have military applications, complicates matters. The US is indeed vulnerable, but not as much as it used to be. In 2018, the US purchased less than 4 percent of Chinese REMs, which is not difficult to understand when one considers just how much of America’s manufacturing base has been shifted outside the country over the past two decades.

A wholesale and sustained cessation of the export of REMs to the US or other countries seems unlikely. If Beijing were to implement a ban, it may prompt companies from around the world to reconsider whether they wish to continue to maintain their manufacturing base in China, or in other countries heavily reliant on China. The global supply chain is multifaceted and resilient, so while an export ban on the US would ultimately impact many of the countries US companies do business with, as was proven in the 2010 Japanese example, smugglers and black marketeers will find ways around any such ban, just as they currently do to bypass American sanctions against Iran and other countries.

The trade war is serving to demonstrate that China is as vulnerable as any other country to trade sanctions and that its own actions can have a profound impact on the Chinese economy. It also serves to re-emphasize that US businesses are as guilty as those from any other country for choosing to make China a centerpiece of their global operations. They have only themselves to blame for continuing to remain in China despite the passage of numerous laws that severely restrict how they may operate and what they must give up–in terms of knowledge, production technology, and intellectual property–for the privilege of doing business in and with China. At what point does the price become too high? The time has come for many companies to address this question.

In a world in which interconnectivity and dependency define the trade and investment landscape, the luxury of pulling high stakes triggers and expecting few enduring consequences has largely disappeared. China’s rare earth bravado failed to achieve its objective in 2010 and it will fail again now if implemented. Given that Trump has proven-again and again that he is willing to go the mat in negotiations with adversaries, there should be little doubt in Beijing’s mind that should it decide to impose an export ban on REMs, the US will respond in kind.

As for Beijing’s ongoing status as the top purchaser of US treasuries, if it continues to sell them, Tokyo will become their top foreign purchaser, which suits it just fine. And, as the world becomes ever more economically nationalistic, it should not come as a surprise to learn that the number one purchasers of US treasuries-by a wide margin-are, in fact, US citizens. That should serve as a reminder that China has less of a chokehold on the US economy than it might imagine.