Tech

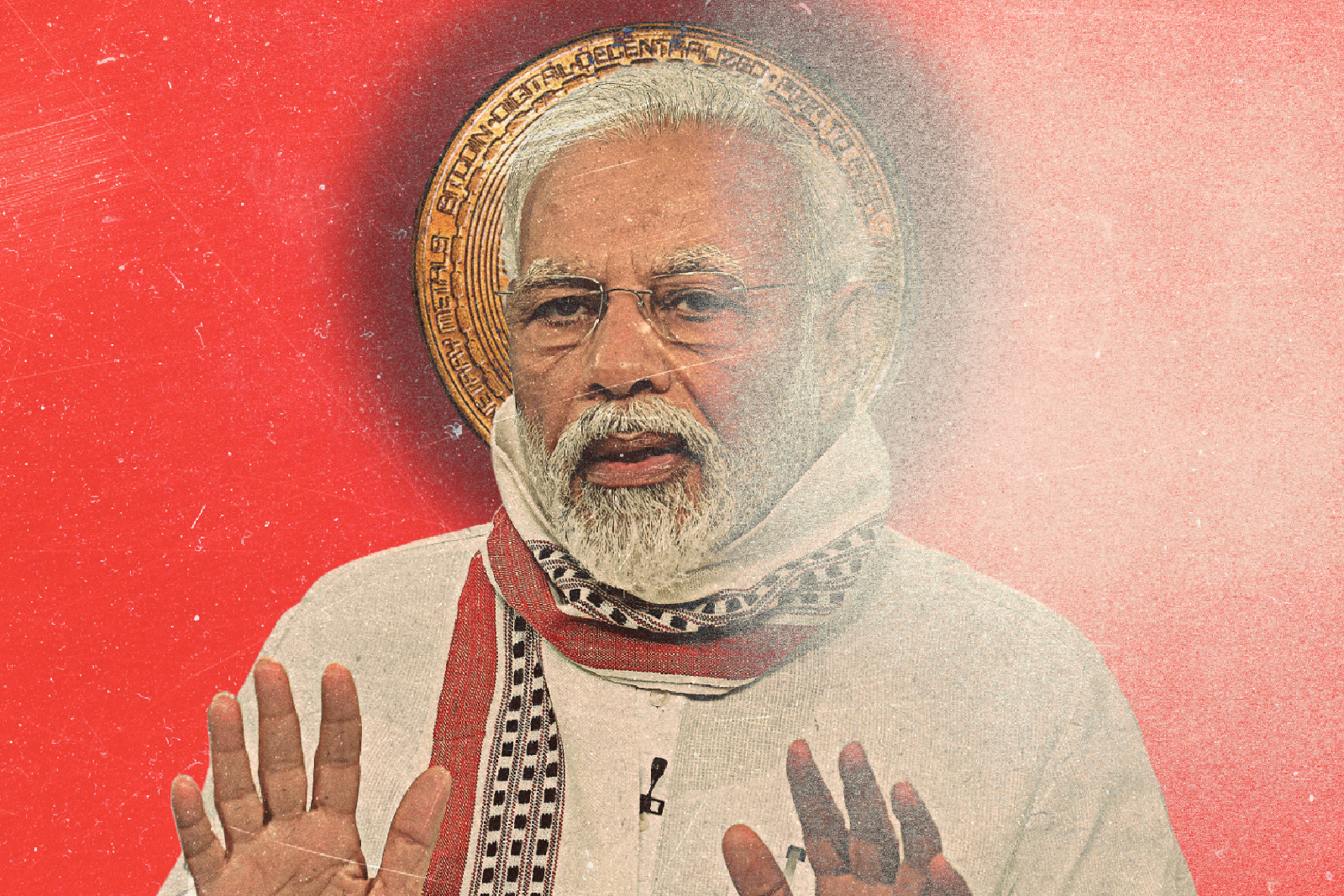

India to Push for Local and Global Crypto Regulations

India, which holds the G20 presidency, has been participating in discussions about the potential risks of unregulated cryptocurrencies. Because of long-held concerns over money laundering and terrorism financing, regulations are expected to be a key feature during discussions.

India has been cautious about crypto due to concerns over abuse. While crypto trading is not prohibited, last year it introduced a high tax rate, which has significantly reduced such activity. Additionally, offsetting losses from one crypto asset with gains from another is now prohibited. New Delhi has also discussed the possibility of stricter regulations but has not taken any concrete steps or landed on exactly what those regulations might be.

India has emphasized the need for international cooperation in addressing the risks of crypto, including sharing information and best practices among countries. India supports efforts to develop global standards for regulating crypto and is committed to working with other countries to ensure the effective implementation of these standards.

Its proposed uniform regulations aim to establish a clear and consistent framework for managing and using crypto. These regulations address various risks, including financial stability, consumer protection, and illicit activities. The overall objective is to promote the responsible and transparent use of crypto while supporting the country’s nascent crypto industry.

The proposed regulations are designed to align the use of crypto with the broader goals of the Indian economy while mitigating risks. New Delhi is seeking a level playing field for all participants in the market and the responsible use of this relatively new technology.

In addition to mitigating the risks, the proposed regulations support innovation and growth in the industry. By providing a clear and stable regulatory environment, India hopes to attract investment, encourage innovation, and promote industry growth, thus contributing to the overall development of the economy.

India’s proposed regulations are expected to contain several key features. Firstly, they may include provisions related to licensing and registration of crypto exchanges and ensuring their compliance. Additionally, the regulations may mandate reporting of suspicious transactions and implementation of anti-money laundering measures and countering the financing of bad actors.

Consumer protection and data privacy provisions may also be included in the proposed regulations and requirements for maintaining records and reporting to the government. The regulations are also likely to outline the responsibilities of various stakeholders in the crypto ecosystem, such as exchanges, wallet providers, and users, setting standards for their operation and conduct.

Moreover, the proposed regulations may specify the types of cryptocurrencies that can be traded or held by individuals or businesses and establish rules for their safe storage and transfer. They may also address issues related to taxation, including the tax implications of holding, buying, and selling crypto and the tax treatment of income generated from crypto-related activities.

Currently, the status of crypto regulations in India is somewhat unclear. While New Delhi has expressed concerns about the potential risks posed by crypto, it has not yet taken any concrete steps to regulate the industry. The central bank has issued several warnings about using crypto but has not yet implemented any specific regulations.

In recent years, there has been growing interest in crypto in India, and many exchanges have emerged to meet this demand. However, without clear and consistent regulations, the use and management of crypto remain largely unregulated.

Crypto regulations may have significant economic implications beyond the industry itself. If the regulations successfully address the risks associated with crypto, they may increase investor confidence and attract more investment into the industry. This could lead to the creation of more job opportunities and promote economic development in the country. On the other hand, if the regulations are overly restrictive, they may hinder the growth of the industry. This could also discourage innovation and investment in related fields, such as blockchain technology, which could limit the growth potential of these industries.

Moreover, if the regulations establish clear guidelines for taxation and provide a framework for the reporting of crypto-related transactions, they could contribute to the growth of government revenue. This could be especially important in light of the economic impact of the pandemic, which has put a strain on government finances.

The proposed regulations for crypto have the potential to impact the wider economy in various ways, depending on their effectiveness and how they are implemented. While they may contribute to increased investor confidence and economic growth, it is important to strike a balance between regulation and innovation to ensure the sustainable development of the crypto industry and the wider economy.

By introducing uniform regulations, the government hopes to ensure that cryptocurrencies are used safely and securely while also protecting investors’ interests. The need for uniformity in the regulation of crypto among G20 countries is a matter of debate. On the one hand, uniform regulations can help ensure a level playing field for businesses and prevent regulatory arbitrage. This can also help to reduce the potential for cross-border risks to the financial system. On the other hand, each country has unique economic, political, and cultural contexts and may have different needs and priorities regarding regulating crypto. For example, some countries may place a higher premium on consumer protection, while others may focus more on anti-money laundering and terrorism financing.

Ultimately, the ideal approach to regulating cryptocurrencies is likely to be a balance between these two perspectives, where countries adopt a standard set of principles while still retaining the flexibility to tailor regulations to their specific circumstances. This approach can help ensure that cryptocurrencies are regulated in a way that promotes innovation, protects consumers, and reduces potential risks to the financial system while respecting individual countries’ sovereignty.

The proposal for the uniform regulation of crypto among G20 countries could potentially delay regulation in individual countries, including India. Being an intergovernmental advisor on blockchain and cryptocurrency matters, I would propose that the Indian government do the same rather than uniform regulations across the entire country, it should be localised. This approach can have several advantages, such as allowing for a more flexible and agile regulatory framework that can respond quickly to market changes and industry needs.

Localised regulations can also take into account the specific needs and circumstances of different regions and jurisdictions and allow for the development of regulations tailored to the local context and priorities. This can be especially important in a country as diverse and complex as India, where there may be significant regional variations in the needs and challenges faced by the industry.

Recent events in the market have highlighted the need for some form of regulation in the industry, given the potential risks associated with cryptocurrencies such as price volatility, lack of investor protection, and potential for illegal activities. The proposed uniform regulations in India aim to provide a clear and consistent framework for using and managing cryptocurrencies, while also promoting the growth and innovation of the industry. While the impact of these regulations on the wider Indian economy remains to be seen, their successful implementation could increase investor confidence and boost economic development.

The timeline for introducing these regulations has not been officially announced yet, but it is expected to be presented sooner rather than later. Hopefully, concrete and reasonable regulations will emerge from this meeting, but only time will tell.