Business

A Step towards UBI: Analysis of the GAIN Act

This is an analysis of a bill in the House of Representatives, The GAIN Act, which aims to massively expand the Earned Income Tax Credit (EITC) program, up to $12,000. It has been proposed by Rep. Ro Khanna (CA-17). In the name of disclosure, I had a hand in initiating the bill and helped to estimate the costs of a generically large EITC.

Since 1975, both parties have broadly supported a work-conditional cash transfer program known as the EITC, where the government matches income earned on the job with an annual tax credit in a U-shaped payout curve. In the graph below, a single mother of 3 would get roughly $5,800, if she earned $10,000 in yearly income (and roughly half the credit if she earned $30,000).

In response to automated job loss and wage stagnation, Congressman Ro Khanna (CA-17) has proposed a large expansion of up to $3,000 for childless workers and $12,000 for large families.

It is unclear whether the Republican plan for corporate tax cuts will boost job growth, since tech companies, which are embracing automation and outsourcing, will be the largest beneficiaries. After a similar tax holiday in 2004 on repatriated dollars, many tech companies lost, not gained, jobs.

There has been an increasingly large gap between productivity and hourly wages, as automation concentrates more wealth into the relatively few high-skill workers who operate software and robots, complicating how much a tax cut will benefit the average American.

“US corporate profits have been robust, companies’ domestic cash reserves are high, and interest rates have been quite low…In short, US firms have not been hobbled by a lack of money to invest in, for example, new facilities. So I don’t see how a corporate tax cut would quickly and directly cause them to start hiring more,” said Dr. Andrew McAfee, MIT economist and author of a new book on automation, Machine, Platform, Crowd.

There is a lot of evidence that an expanded Earned Income Tax Credit would have benefits (though there is no evidence on the effects of tax credits over $6,000). A $1,000 increase in the EITC boosts employment a sizable 7%. A tax credit boosts educational outcomes comparably to publicly funded Pre-K. The liberal think tank Center for American Progress estimates that an EITC could save billions in reduced crime and other side effects of poverty.

Moreover, small companies create a disproportionate number of net new jobs, as large companies tend to prioritize efficiency over more labor. Many small businesses, which run at an operating loss, would not benefit from tax cuts.

Politically, some (very) preliminary polling I conducted suggests a tax credit could be more popular than a corporate tax break, is seen as political viable by leading economists and has 50 co-sponsors in the House.

“The EITC, in addition to being good economics and encouraging more low income people to work, gives Democrats an entree into the world of tax cuts that doesn’t focus on the groups at the top, where they don’t really need more tax cuts. It focuses on the low-middle income workers of the country who have struggled to make it in the last couple of decades. In my view, that makes a large expansion of the EITC a realistic policy goals for the Democratic Party,” said Austan Goolsbee, the former Chairman of President Obama’s Economic Advisors.

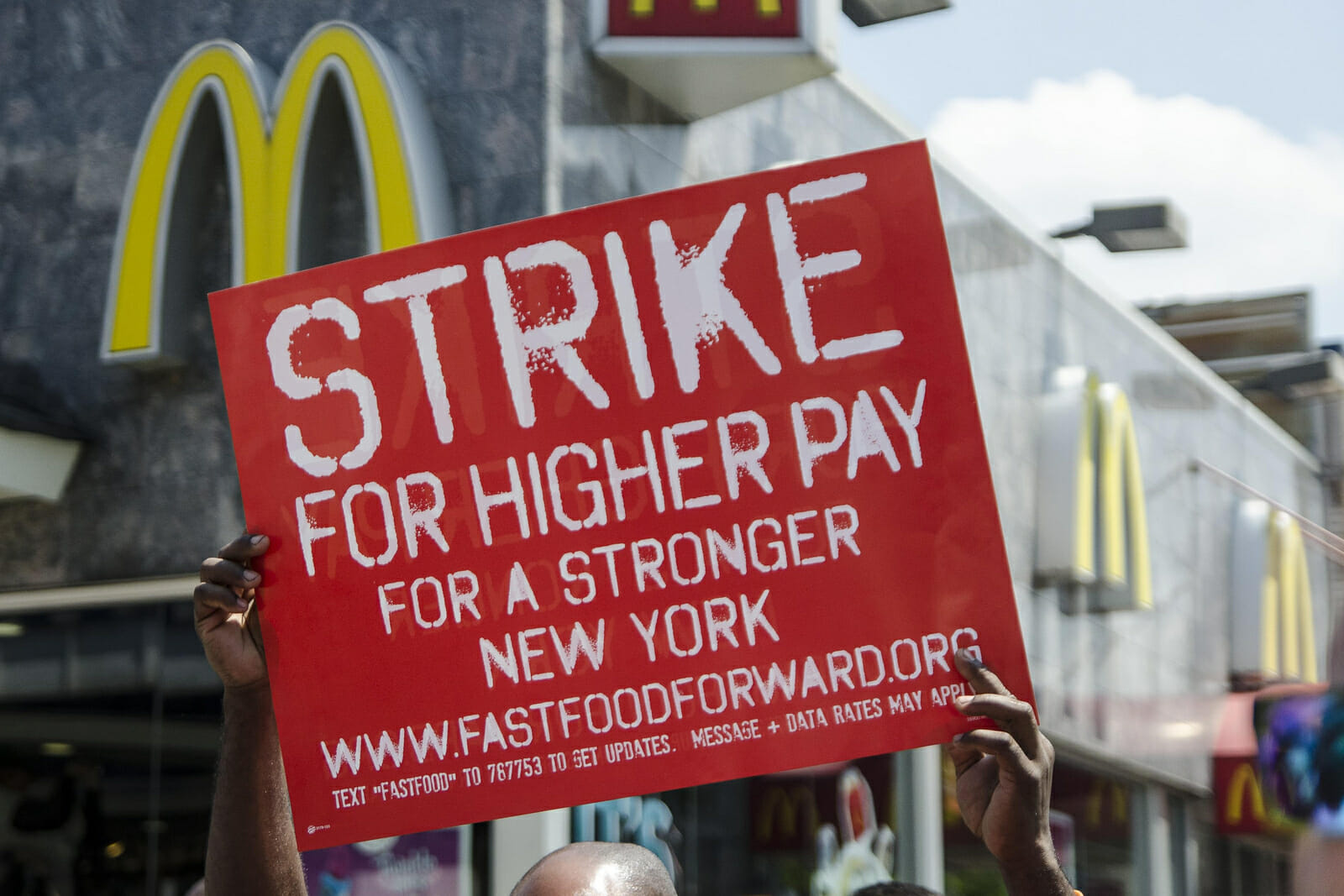

Swiftly after Donald Trump celebrated dissuading United Technologies from opening a plant in Mexico, the CEO of the manufacturer’s parent company admitted that he would have to actually automate many of the jobs the president had hoped would come back to America… The GOP’s plan to resuscitate American industries hollowed out by 20th century trade deals appears to have underestimated 21st century challenges. Indeed, automation seems to be a stumbling block for nearly every known worker-protection policy option. The former CEO of McDonald’s said that the company will likely replace cashiers with touch screens in response to minimum wage hikes.

As a result, promises of corporate tax cut-fueled growth don’t appear any more promising. After 2004, when America’s largest corporations were enticed to repatriate their overseas cash holdings with a generous tax holiday, many of the tech giants ended up cutting jobs, according to a Senate report led by then-Democratic chair Carl Levin. Hewlett Packard shed 8,000 US jobs; IBM shed 12,000.

Today, according to finance firm Moody’s, the top 5 cash holders are all from the tech industry — and they don’t create jobs like older industries. The Wall Street Journal reports that Google relies heavily on independent contractors, employing a “roughly equal” number of staff and outsourced workers, many of whom work on the company’s self-driving car technology, which could, itself, wipe out millions of jobs.

Though the bill is unlikely to pass, Khanna’s novel idea gives the Democrats a fascinating opportunity to start a national conversation around what corporate tax cuts would actually do for the average American, and why a step towards a basic income might be more appropriate in the new century.

The Earned Income Tax Credit began as the brainchild of the libertarian hero Milton Friedman. “The system would fit directly into our current income tax system and could be administered along with it,” dreamed Friedman in his influential book Capitalism and Freedom. “The advantages of this arrangement are clear. It is directed specifically at the problem of poverty. It gives help in the form most useful to the individual, namely, cash.” Milton believed liquidating a sprawling welfare state into a simple cash program would treat citizens more like adults and encourage them to find work.

The University of Chicago economist was influential enough to have his ideas codified into federal law, when Republican President Gerald Ford initiated the Earned Income Tax Credit under the 1975 Tax Reduction Act. Years later the once small program was expanded by President Ronald Reagan. To repeat: a large cash government handout was proposed by libertarian economist and enacted into law by a Republican President under the name of a law literally named to reduce taxes.

Today, large cash transfers have a new champion: tech titans. Facebook co-founder Dustin Moskowitz has donated tens of millions to GiveDirectly, a nonprofit charity that promotes cash donations rather than traditional international aid programs. Moskowitz’s old colleague, Facebook co-founder Chris Hughes, has become a proponent of “Universal Basic Income,” a theoretical policy of guaranteeing every citizen a livable wage, paid for with a check from the government. Hughes recently plowed $10 million into the Economic Security Project, an organization dedicated to researching the economics and political implications of basic income. Many tech titans believe that technology will inevitably exacerbate income inequality and only a large cash redistribution system can blunt the impact of automation.

How the EITC works

The negative income tax program has a U-shaped curve, where lower income individuals are given increasing amounts of matching funds from the government for every dollar they earn on the job (the “phase-in” rate), until they reach a peak benefit, after which matching slowly tapers off for each dollar earned.

For economists, the Earned Income Tax Credit is one of the most elegant policy interventions imaginable. It’s hard to construct a better natural experiment for testing whether money motivates people in the real world. One National Bureau of Economic Research paper found that increasing the credit by $1,000 spiked labor participation by single mothers 7% points and reduced household poverty by 9%.

But, perhaps the more exciting finding from EITC’s has been the extraordinary ancillary social benefits. For instance, Brookings Institute researcher Russ Whitehurst found that the tax credits are more effective per dollar at raising low-income children’s’ academic performance than government funded head start school.

Why does cash work so well?

One study has been particularly informative the pro-market think tank, The Niskanen Center reviewed evidence comparing Canada’s Child Tax Credit and a massive expansion of state-sponsored child care services. The Child Tax Credit had remarkably positive long-term benefits to both the health of mothers and the academic development of their children.

However, one study of child care services find that “children are worse off in a variety of behavioral and health dimensions, ranging from aggression to motor-social skills to illness. Our analysis also suggests that the new child care program led to more hostile, less consistent parenting, worse parental health, and lower-quality parental relationships.” Severe economic hardship, especially from the loss of a job, corrodes families from the inside out. Anger, stress, and inflexible work hours trickle down into child upbringing that stunts development for years to come.

Now, to be extra clear, this shouldn’t be taken as a critique of government-run welfare programs, which often have enormous positive social impact, but, cash transfers do appear to have more predictable positive outcomes. Hence, when considering the cost of an EITC, evidence suggests there’s a high probability it will achieve a number of socially desirable outcomes, however incomplete or expensive.

The New Proposal

Khanna’s still-forming policy would double the current EITC for families, from roughly $5,500 to $12,000 and raise it for childless workers 5x, from $500 to $3,000. Elaine Maag from the Tax Policy Center estimates how such a policy would impact long run federal revenue and concludes that it would add $2.4 trillion dollars to the federal deficit over the next decade. She also ran numbers for the full gamut of an expanded EITC, up to $18,000 for a family of 3 ($10,000 for singles), the first such estimation of an EITC that large that any expert I spoke to had seen. A super credit would cost between $6 to 7 trillion dollars.

The Alternative: Corporate Tax Cuts

Giving working families upwards of $12,000 isn’t cheap; but, then again, neither is giving corporations a massive tax cut. According to the Tax Policy Center, President Trump’s (still forming) plan to reduce the corporate tax rate to 15%, plus a temporary tax holiday of 10% for companies stashing cash abroad, would cost somewhere between $6–7 trillion over the next decade, the same as Ro Khanna’s super EITC credit.

Tax cuts, stock buybacks, and income inequality

The evidence that tech companies will use tax cuts for job growth is seriously questionable. Tech companies themselves admit they are unlikely to invest much of the money. For instance, Fortune reports that Goldman Sachs estimates that large companies will use 3/4 of the $200 billion they are likely to repatriate on stock buybacks. An Apple executive recently admitted that the company wouldn’t use much of a tax cut to hire American workers, but rather for investment or other unnamed financial purposes. Even if tech companies did use tax cuts for hiring, there are structural changes in the new knowledge economy that will likely get worse.

A major change that occurred over the last few decades is the widening gap between labor and productivity, as the same number of workers produce far more output. It used to take 25 people in manufacturing to produce $1 million worth of goods — now, it takes 7. Compared to a company like Wal-Mart, Apple and Google are far more likely to invest their windfall on self-driving cars or iPads — two technologies dramatically accelerating automated job loss. Even for large companies with a US-based workforce, Silicon Valley employs far fewer people than old established technology companies. Facebook has a workforce roughly 5% the size of General Electric (17,000 versus 300,000).

In other words, a tax cut may just go to a smaller share of highly skilled workers who operate machines and software. It may be possible to retrain workers for new jobs, but they’ll need to be supported during that time.

Robots, constant retraining, and the gig economy

MIT’s Daron Acemoglu has a new paper arguing that automation isn’t necessarily the death of employment. Over the long run, he argues, it’s possible that robots will create entire new categories of jobs. However, the transition between destruction and new job creation could take a long time. Corporate tax cuts accelerate the pace of change while (potentially) doing little to help the millions of workers displaced during these jobless transition periods.

One potential use of large tax credits is for workers to help pay their way during retraining while working in the gig economy. Already, many college students use Uber’s flexible schedule to earn money while they attend school. A large tax credit could both reduce the amount of time needed to work in the gig economy and increase the overall wages needed to make a living while learning. While an imprecise retraining policy, large tax credits could provide an important buffer from automated job loss and vocational education.

Growth, startups and debt

While Khanna’s plan may appear like a form of welfare, it may, in fact, promote greater job growth than giving giant corporations hundreds of billions of dollars in tax cuts. According to The Kauffman Foundation, high growth startups — companies with double digit growth — account for a disproportionate share of net new jobs. Kauffman research analyst Arnobio Morelix tells me this is because older industries tend to shed more jobs than they generate; now past their most innovative period, established giants are focused more on making their existing business operations more efficient with robots and outsourcing (think Uber’s self-driving cars or auto manufacturers).

Theoretically, a quasi-basic income in the form of a giant tax credit could give Ramen Noodle-fueled startup founders the economic security necessary to take risks. During the course of the story, I reached out to several startup founders who had gone through the famous Bay Area Y Combinator entrepreneurship program, asking them about whether a tax credit of $6,000 would have realistically made any difference. For many startup founders living in San Francisco, $6,000 wasn’t a whole lot of money. However, for Middle America, it is quite a sum. For instance, YC alum Jesse Vollmar built his own Michigan-based agricultural data analytics firm for, Farmlogs, with just $500 in 2012. Though Vollmar says the company is set to double its workforce over the next year, most of his revenue gets plowed back into the business. “For FarmLogs, the business demanded that we operate at a loss for the first few years. In that case, a lower tax rate would not have helped us at all and a tax credit would have.”

If scrappy startups are the future of work and growth in Middle America, tax credits might be more pro-business than a tax cut. Not every economist, however, was convinced that tax credits were a good policy tool for promoting startup growth. The American Enterprise Institute’s Stan

Veuger told me that he wasn’t terribly optimistic that $6,000 would be sufficient, especially since targeted tech policy might be cheaper. “I think more money for R&D, funding for high-end STEM training and research, and increased high-skilled immigration would be more effective.”

College, Entrepreneurship, and Paying-Off Debt Quicker

College debt is a severe impediment to entrepreneurship. The Philadelphia Fed estimates that students with about $25,000 worth of student debt are about 10% less likely to become entrepreneurs. Another study found that student debt had a particularly pernicious effect on technology firms, eclipsing the advantage that inherited family wealth gives some entrepreneurs. That is, the damage of student debt appears to go beyond region, social class, and industry.

My conversations with Y-Combinator startup founders confirmed this research. “My co-founder had a lot of college debt and we got very low on funds. He was very stressed by the situation and ultimately decided he needed to go get a job. I think we might have succeeded if not for that, as we were getting close to cracking the market,” said Matt Krisiloff, in response to a question about how student debt may be impacting entrepreneurship (full disclosure: Krisiloff helps with YC’s basic income research project).

A $6,800 tax credit could help dramatically reduce the burden of student debt. Startup founders could either work a few years to pay off the debt or work part-time while building a company. Khanna’s plan may not be the most precise tax credit for reducing student debt, but it is one option.

Political viability

Ambitious policy ideas are often best teed up by parties in the political minority; it is when they have the least power that they are most flexible with the kinds of ideas they can propose. Indeed, it is how now-Speaker Paul Ryan’s budget became the Republican platform when it was first proposed as the conservative alternative years ago.

So, could an expanded EITC or basic income become the Democratic alternative? Khanna’s plan has inspired support from the unusual alliances beginning to form around cash transfers. Andy Stern, former President of the labor union SEIU, and author of a new book on basic minimum income, worries that neither party is addressing 21st century labor problems. “I think the silence is deafening, in general, in Congress when it comes to the potential for technological disruption or unemployment… An expanded EITC in terms of the amount and for coverage of single working adults is an immense value.”

Many More Questions Remain

None of the economists I spoke to thought it was easy to predict how a massive tax cut (or credit) would impact the economy, given all the recent trends in labor and automation. Thus, even if Khanna’s bill becomes a viable policy alternative for Democrats, the final product may need substantial revisions.

So, I reached out to liberal groups and other experts to see how they might revise a massive tax credit policy. Rachel West of The Center for American Progress worried that some of the tax credit may just end up in corporate pockets, as previous research suggests that employers capture about $0.27 for every dollar of a tax credit through reduced wages. She suggested that a tax credit may have to be paired with a higher minimum wage.

Policies of this magnitude raise a lot of questions and may need to be paired with other welfare reforms. As large cash transfers go from a popular abstract idea to actual policy, the details matter. Khanna’s plan has the potential to be the Democratic alternative to corporate tax cuts, if economists and other business leaders help mold it into a polished vision of the future of welfare and work.