Business

Building a Strategic Brand Narrative for China’s Luxury Market

打造中国奢侈品市场战略品牌叙述

Pedigree. Now there is a word you don’t hear often. Once wreathed in notions long associated with descent and civilité, the appellation has given way to new slang prominent among the outlandish and über-privileged: bling.

The ebb and flow of empire are being reflected in the consumption of luxury goods among the world’s nouveau riche. From Europe, first came the heirs of conquest; next, U.S. titans of industry, followed by the Sheikhdoms of the Middle East, tech-powerhouses from Japan and Korea, and post-Iron Curtain Russians.

Yet, it’s the shift in consumption among China’s newly moneyed that has luxury labels salivating over access to its $17.3 billion share of the global market. From exclusive yacht exhibitions to $1 billion replicas of entire Austrian villages, “Generation Y” has made it clear there is plenty of Yuan to go around with no sign of letting up.

Don’t think so?

Tell me the last time you dropped $16K on banana-eating lessons.

Bain & Company estimate that global luxury consumption grew at 4%, clocking in at just over $1trillion in 2016. Post-Brexit and U.S. geopolitical uncertainty, declining productivity, currency depreciations, and the proliferation of terrorism in Europe, have all contributed to flattened sales in luxury personal goods—despite Asia Pacific’s impressive 5% growth.

As the world economy creeps, however, High Net Worth Individuals (HNWI) “are allocating more of their income to lifestyle services and experiences such as spas, travel, and entertainment.” That doesn’t mean that personal luxury goods consumption has gone out of the window.

It does mean, however, that luxe and ultra-luxe brand experiences will have to work much harder to capture the attention and loyalty of an increasingly sophisticated, digitally-driven public.

Here are three takeaways for building your brand in Asia. I offer as illustration China’s place in global blingdom.

Brand Narrative Is Brand Clarity

品牌叙述是品牌的清晰度和透明度

One: brand narrative is about brand clarity.

Building narrative means more than having a logo, tagline, or positioning statement. While these are important starting points, it’s about determining how your brand will be experienced. Narrative explains the role a brand plays in a person’s life. It is the soul of your brand. Maurice Saatchi summed it up as “one-word equity.”

Tom Doctoroff, CEO of J. Walter Thompson Asia Pacific and author of Twitter is Not a Strategy, put it this way, “Take great care before you pick your word…Sweat comes from the ruthless paring down of the paragraph to the sentence and the sentence down to the word. Brand ideas must be ruthlessly simple, but reducing them to a single word carries the brevity imperative too far and risks losing people completely.”

Narrative should be one idea, but not necessarily one word. The point is to explain why your brand exists and how it can resolve conflicts in the lives of your buyers.

The clearer you are about the role that your brand plays in a person’s life, the better you will be at defining your brand niche, identifying brand personas, and your desired audience. Once you understand your niche and define your UBO (Unique Brand Offering), you will be better suited to design and execute a well thought out PR strategy: objectives, key messaging, target media, media and blog pitch angles.

As such, word choice, tone of voice and concept, as well as metaphor and narrative model, must not only work to establish and nurture a long-term relationship with buyers, but demonstrate connoisseurship and refinement as indications of evolving taste. Key word: evolving.

Cue Medusa.

Be Globally Consistent, Locally Relevant

保持全球一致, 立足本地思考

Medusa is Versace’s iconic brand logo-cum-visual narrative. In Greek mythology, she was the only mortal of three sisters. Her original beauty seduced Poseidon, god of the Sea. Jealous and outraged, Athena turned Medusa’s hair into snakes. Anyone who laid eyes on her thereafter was turned into stone. Although mortal, her seduction of Poseidon was epic—dare I say, status-defining.

As myth, Medusa’s story evokes desire, fearlessness, transformation, and the creative, rebalancing force of life. As visual narrative, it says, “Versace’s beauty is immediately recognizable; inescapable; status-defining. One’s life is forever transformed, having experienced it; and there is no turning back.”

Garish as it is glamorous, Vesace’s brand narrative is about a style of life that represents heritage, pedigree: haute couture, fashion & lifestyle products, home furnishings. It’s brand personality is about the whole person.

China is not there yet.

It is, however, moving in that direction, as evinced by Versace’s overt play to China’s tricked out, dropping two flagship hotels, and a 2017 Chinese New Year Palazzo bag.

For Radha Chadha & Paul Husband, luxury evolves in five stages: subjugation, start of money, show off, fit in, and way of life: “China is at the show off stage. Wealth has arrived to select segments of society, concentrated in the coast cities, and these people are tripping over each other trying to acquire the symbols of wealth and displaying them in the most conspicuous manner.”

Yet, as Jing Daily’s Yiling Pan observes, China is switching from an export-driven economy to one of consumption. Luxe consumption in second-tier Chinese cities such as Hangzou and Xiamen is set to reach $9.7 trillion by 2030.

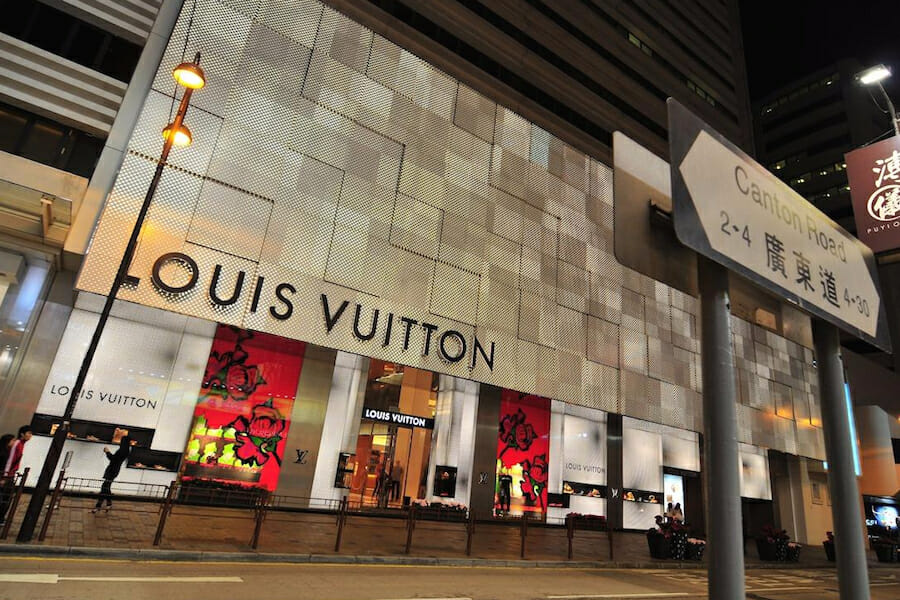

Moreover, the shift from first to second and third-tier consumption in Chinese society represents per capita disposable income for urban households climbing to $8K. Louis Vuitton, for instance, has already set up in Kunming, Shijiazhuang, and Zhenzhou, with other luxe labels following suit.

Despite Versace’s immense power as a brand, it remains a family business that has been relatively quiet in China; LVMH, Richemont and Gucci, however, are juggernauts that have been in play since the late 80s/ early 90s. Managing everything from Louis Vuitton and Mont Blanc to Piaget and Gucci, the big 3 have built an emotional connection with Asian consumers; more than brands, they have become markers of status and relevance because they are passports to upward advancement.

“Mont Blanc has become popular in China because it resolves a tension between these two competing cultural truths: the desire to project accomplishments but also the need to be understated, to obey the rules…Outside Europe and the Western Hemisphere, ‘how it makes me look’ always trumps ‘how it makes me feel.’”

So…

Two: Do your homework. Be keenly aware of culture’s omnipresence when shaping brand concept; Be cognizant of the subtle nuances at play in diverse cultures so that your brand becomes globally consistent, and locally relevant to the aspirations of your target buyer.

Digital Experience Is King

数字体验是致胜王牌

Three. Go native…digital native.

China has 594 billionaires, fifty-nine more than the U.S. Sino-luxe travelers also average 28 years of age, over $56 million in personal wealth, spend roughly $600,000 on household travel, and have visited, at minimum, 13 countries—48% of whom cite WeChat subscriptions as their primary information source; Whatsmore, Dior, Prada and Gucci, are the preferred brands among WeChat’s 800 million subscribers.

This is in large part because Chinese consumers account for 30% of global luxe consumption and predicted to reach 35% by 2020. This is also because Kering SA, the French Luxury Group behind Gucci, has put enormous amounts of energy into speaking to the Chinese public: “We learnt that a very serious risk is to become complacent, to think that it’s easy business, an easy customer base, easy to open stores with good products and then people will come in. That was true for a moment but Chinese customers have become sophisticated and highly demanding and we need to adapt.”

This, as Asia leads Europe, the US, and Japan in organic sales for fashion powerhouse LVMH. With the industry in flux, LVMH’s success signals a turnaround for the industry. Pay attention.

Follow LVMH and Gucci. Make use of platforms such as WeChat and Toutiao; take advantage of video in developing your marketing strategy; embrace mobile payment platforms, and work on building online communities.

If you are seriously considering taking your brand global, China is the future. For, as someone once said, “Luxury in China is not frivolous. It’s not superficial…luxury is a tool of success on the battlefield of life.”