Under the Microscope: President’s Offshore Assets Cause a Stir in Mongolia

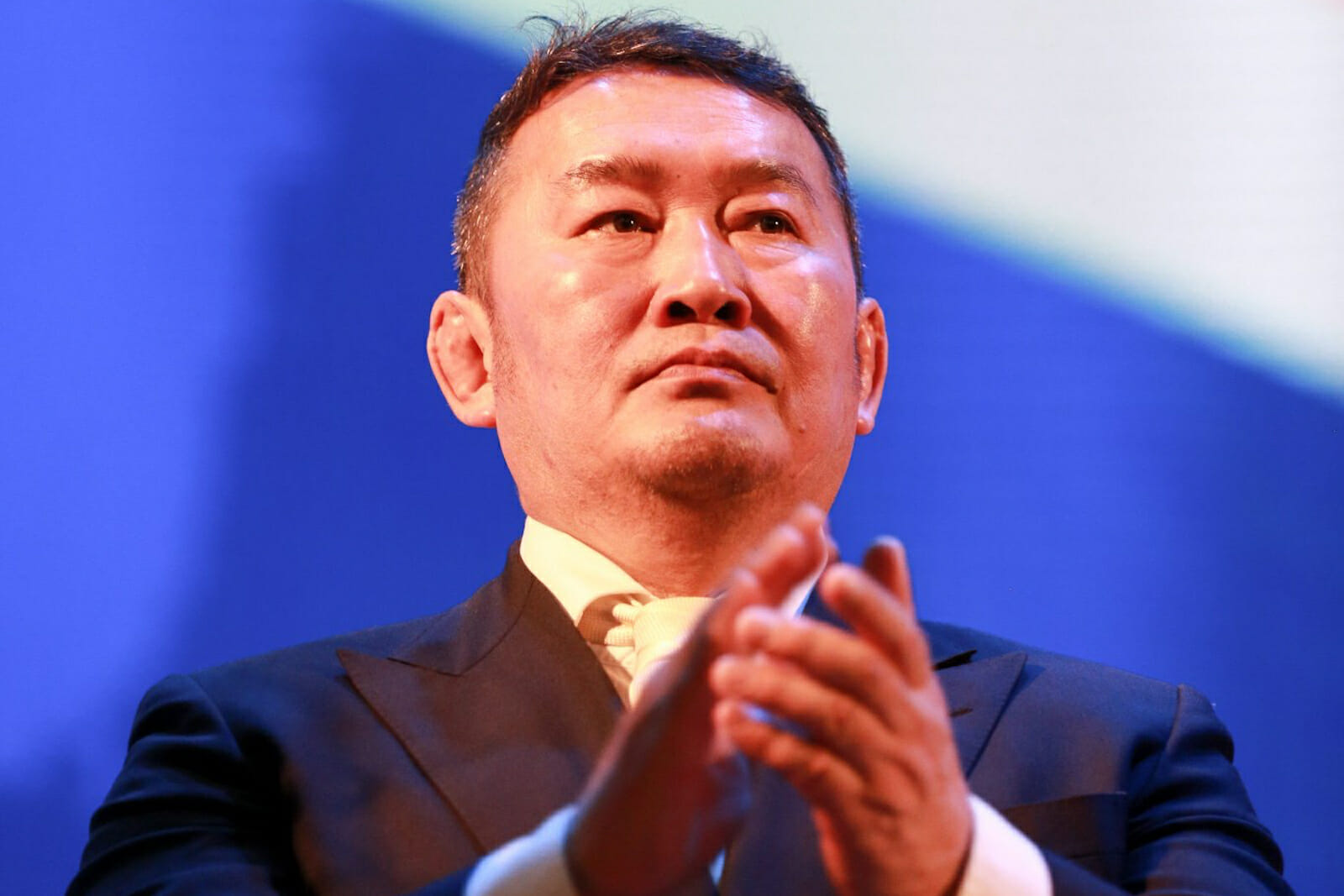

When Khaltmaagiin Battulga ran for the presidency of Mongolia, he campaigned 0n purging local corruption and holding the country’s economic elite to account.

Battulga made it a central plank of his election campaign that when he became president he would move swiftly and decisively to punish those responsible and to repatriate funds and investments held in offshore tax havens.

Since becoming president in 2017, however, he has been noticeably slow to do much to make this happen. The reason for his reluctance may be explained by the revelation that he and his family have close involvement in an offshore company.

In April 2017, Mongolia amended the law on conflicts of interest which strictly prohibits government officials and their close relatives and associates from owning property or companies offshore. The penalty for violation is the loss of office. Under that law, Singapore is such a designated offshore zone.

It can be disclosed that Genco Holding, a Singapore registered company, is 50 percent owned by Battulga through his daughter Namuun, and the remaining 50 percent is owned by Battulga’s investment manager Billy Lim via his son Dennis. Namuun Battulga and Dennis Lim are directors of the company.

Singapore documents show that until 2007, Battulga also held a senior position at Genco Holding. At that time, he was an elected member of Parliament and should not have been engaging in any business activity, especially as an officer of a company based offshore.

Battulga was a shareholder in Genco Holding and transferred his stake to his daughter. According to Singapore documents, Genco Holding was established with a share capital of $1 million. Genco is described as a wholesale trader in a variety of goods, including electronic components.

In Mongolia, Battulga’s reputation is that of a highly successful businessman and strongman. A sambo wrestling champion, he loves his tough-guy image, sporting a fedora and naming his Mongolian company Genco, the same title as the Corleone family front business in The Godfather mafia epic – a favourite of Battulga’s.

Genco grew on the back of the privatisation of state interests, acquiring hotels and food production factories. The company also moved into taxi services, retailing, lotteries, night clubs, and restaurants.

Battulga founded another company, Camex, in Mongolia, and its subsidiaries obtained 17 valuable licenses for coal, gold, and copper. Battulga owned 90 percent of Camex, and Ard Batsukh owned the other 10 percent. In 2007, Battulga transferred his Camex stock to Namuun and to his sister, Tsendsuren Khaltmaa.

This was all declared publicly in Mongolia. What was not known until now, however, was that ownership of the Mongolia Camex was in fact soon transferred to another Camex company, registered in Singapore. This Camex leases offices from Genco Holding and operates from the same Singapore address.

Camex in Singapore is owned by a company called Well Delight, located in another offshore haven, the British Virgin Islands. Well Delight in turn belongs to two other BVI companies, Best State and Sino Access. The shareholders of these BVI companies are Mashbat Bukhbat, secretary-general of the Judo Federation where Battulga was president, Ard Batsukh, and Hui Shin Lim Celestina, daughter of Billy Lim. The two parent offshore companies were later sold to another BVI company called Brave Lion. The purpose of this offshore web is unclear – except to make it harder to penetrate and to hide the identity of the ultimate owner.

In 2010, it was reported by the Hong Kong Stock Exchange that the Tugrug Nuur coal deposit in Mongolia had been sold by Battulga for $250 million to Chinese-owned Ming Shin Waterworks Holdings Limited, registered in the Cayman Islands. Who is behind Ming Shin?

The existence of a Battulga-owned firm in Singapore is bound to provoke questions and considerable anger in Mongolia. At the same time, he may want to show just how much due diligence he did regarding the destination of $250 million from the sale of one of the country’s natural assets.