A Blueprint for a Sovereign Wealth Fund for the United States

With sovereign wealth funds becoming more and more common among nation-states, eventually the United States in order to compete in the global business of investment and finance worldwide, will be forced by circumstances to establish its own sovereign wealth fund (SWF). The wealth of these SWFs are an estimated $7.45 trillion which is being invested worldwide. These investments are also used to project a nation’s political power through the use of their SWFs. Without a SWF of its own, based on natural assets, the United States risks its financial and economic dominance.

The Political Power of Sovereign Wealth Funds

While Norway is listed by the Sovereign Wealth Fund Institute (SWFI) as the world’s largest SWF, in actuality if one counts China’s four SWFs as one, all of the SWFs report to the Chinese Ministry of Finance (MoF). The MoF then reports to the Peoples Bank of China and then the People’s Bank of China reports to the State Council, which is controlled by the Chinese Communist Party (CCP), then China would be classified as the world’s largest SWF with a value of over $1.5 trillion.

Chinese state-owned enterprises (SOE’s) are used by China to apply political pressure in countries by making loans available to countries starved for capital investment, but under terms which quickly ensnare these countries in what has come to be called a debt-trap.

Some examples of the use of a debt-trap used by China is the loans extended from the Exim Bank of China to the nation of Sri Lanka for the construction of the Hambantota Port as well as the Mattala Rajapaksa International Airport. China has also loaned large amounts of capital to Kenya, which is at risk of defaulting on its loans, which would mean that China would be able to seize the Kenyan Port of Mombassa. The Port of Mombasa is the largest deepwater port on the African continent on the Indian Ocean. If the Chinese were able to establish a naval base there, then India would be encircled by a hostile power.

Besides China, the United Arab Emirates (UAE) uses its SWF for geopolitical purposes. The UAE’s SWF, the Abu Dhabi Investment Authority (ADIA), is not only used to provide for the UAE when the oil runs out, but it is also used for geopolitical purposes to not only ensure its own national security but to establish zones of influence that allows the UAE to exert economic, political and military influence over its neighbors, to include Saudi Arabia. The ADIA purchased DP World in 2006 and has also taken out a 30-year lease with a 10-year automatic concession for the Port of Berbera on the Red Sea which DP World is developing. Port Berbera is located just across from Yemen and sits on a chokepoint through which 30 million barrels of oil pass through each day. The UAE funds Somaliland, a breakaway province of Somalia, and also trains the Somaliland military. These are only a few of the countries which are using the capital earned by their SWFs to extend their political control over other nations. Without its own SWF, the United States will soon be outspent in foreign aid and influence, and in areas of the world which can affect its national security.

Common Objections to the Establishment Of a U.S. Sovereign Wealth Fund

Cato Institute Senior Fellow Michael Tanner, in Congressional testimony about the establishment of a sovereign wealth fund in the U.S., stated that allowing the U.S. government to use government funds to invest in private equity markets would usher in a socialization of the private market. Mr. Tanner was discussing with the House Committee about using the U.S. Social Security Fund to fund an initial SWF. He was not discussing establishing a U.S. SWF based on the mineral resources on federal land. The Alaskan Permanent Fund and the Norwegian Government Pension Fund are examples of SWFs which use natural resources to fund and create their own SWFs.

One of Mr. Tanner’s most forceful objections to the establishment of a SWF would be the ability of political leaders of either political party in control of the mechanisms of government to pick winners and losers in the stock market and interfere with the concept of supply and demand which is the backbone of a capitalist economy and capitalist theory.

Yet, the Federal Reserve Bank of the United States, which acts as the central bank of the U.S. economy has been able to avoid such political influence in its Federal Open Market Committee (FOMC). The Fed was established by the Federal Reserve Act of 1913, which allows for the political independence of the Fed in regards to its mission.

The Fed walks a tightrope in order to accomplish its mission of maintaining low employment and preventing the U.S. economy from generating inflation which is harmful to the U.S. economy. The attempts by political leaders to use political pressure against the Fed to lower interest rates illustrates a point made by Mr. Tanner in his testimony to a Congressional Committee in 2008:

“Those looking for evidence of this temptation need look no further than attempts by the Clinton administration to force private pension plans to invest a portion of their portfolio in ‘socially redeeming’ ways. Actually, the last days of the Bush administration saw the first exploration of the idea of directing private pension investment. In November 1992, the Labor Department released a report discussing a procedure for valuing the ‘net externalities’ of investments as a way of broadening the prevailing rate test permitted under ERISA to allow for politically targeted investments. The Clinton administration jumped on the idea with undisguised enthusiasm. In September 1993, Olena Berg, the Assistant Secretary of Labor for Pensions and Welfare Benefits, announced an expansive interpretation of the prevailing rate test that would ‘allow collateral benefits to be considered in making investment decisions.’ She especially urged pension fund investment in ‘firms that invest in their own workforce.’”

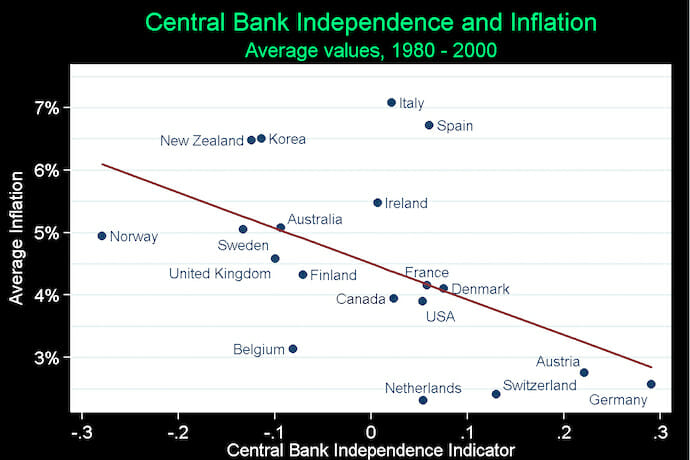

The graph below by Econofact.org shows the relationship between a central bank’s independence and the rate of inflation that is tied to the political control of the central banks:

A Proposed Constitutional Amendment to Establish and Protect a U.S. Sovereign Wealth Fund

Like the Alaskan Permanent Fund, which is protected by a state Constitutional Amendment, a U.S. federal sovereign wealth fund should be created by a constitutional amendment to the U.S. Constitution:

-

- A federal U.S. sovereign wealth fund (USSWF) shall be an independent investment firm using monies obtained by taking control of the mineral resources of the United States that are on federal land. The use of funds in the Social Security Fund might be considered at a later time. Employees of the USSWF shall be federal civil service employees and paid according to federal civil service pay rates.

- The USSWF should nominally fall under the control of the U.S. Federal Reserve, but the Director and its executive committee would be nominated by the president with the advice and consent of the U.S. Senate. The officers of the USSWF would have to be approved by a 2/3rds vote of the U.S. Senate. The USSWF should be required to report to the House of Representatives, and the U.S. Senate on a quarterly basis to advise the House and Senate of its intentions, and to answer any questions the political representatives of the American people might have as to the conduct of the USSWF.

- The USSWF would absorb the Bureau Land Management (BLM) in order to access the mineral wealth of federal lands.

- The current level of royalties paid to the U.S. government for the extraction of mineral wealth on federal lands would be changed from 12.5 percent to a set fee to be established by the USSWF. The fee established would require approval by the House by majority vote, but by 60 votes by the U.S. Senate.

- The Charter for the USSWF would be to promote the welfare of the American people, in cooperation with the legislative and executive branches.

- The USSWF would establish a base fund known as the principal. The principal would be inflation-indexed and increased each decade so as to be available for future generations of the American people.

- The USSWF shall deposit into the U.S. Treasury the profits from the USSWF investments after the principal of the USSWF has been increased to protect the principal from inflation on an annual basis. The funds deposited into the U.S. Treasury shall be spent and apportioned by the House and Senate, with the concurrence of the executive branch.

- The USSWF will act in accordance with the Santiago Principles and governed as a matter of federal law.

With the establishment of a federal sovereign wealth fund, the immense mineral wealth on federal lands would make the United States the premier economic power in the world for at least 100 years, if not more.