The Jones Act – Trouble in Paradise

Imagine yourself on a trip to paradise, a dream vacation to beautiful Hawaii. Eating out has been a treat but it is hitting your wallet hard. You make your way to the local grocery store but almost everything is more expensive. A gallon of milk back home can cost you around $2.39 but here it costs $5.39, a classic branded cereal that you love is now $4.99 to the usual $2.75, and so on. As you tally up your cart, there are no savings. Why is everything so expensive? Hawaii is part of the United States; however, life is not equal when it comes to shipping goods.

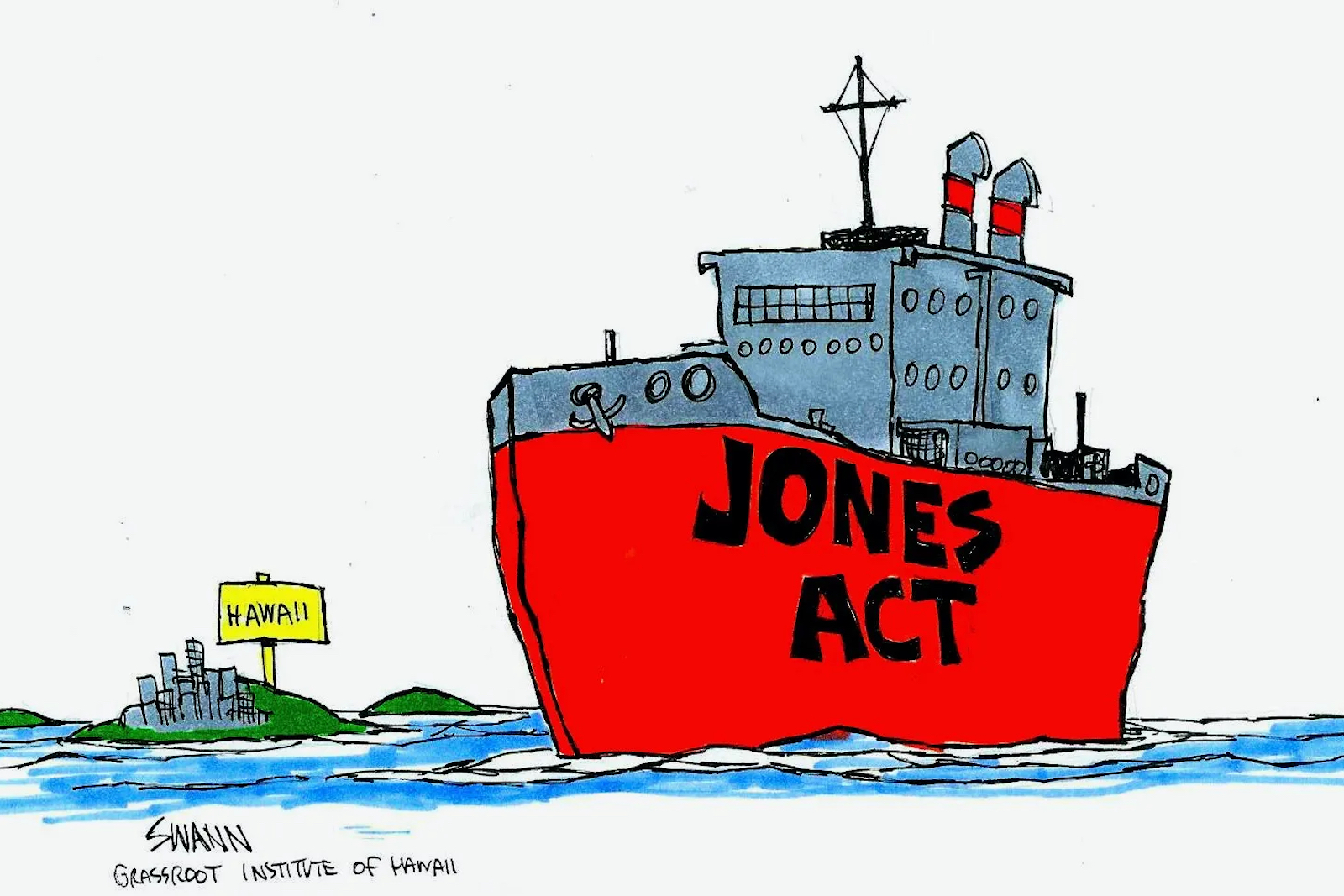

The reason why prices are so high in Hawaii is because of the Jones Act. Also known as Section 27 of the Merchant Marine Act of 1920, the law requires ships moving cargo between two points in the U.S. to be built in the U.S., owned and crewed by U.S. citizens, and registered or “flagged” in the U.S. For example, a big container ship from China bypasses the state on its way to West Coast ports. Some of its cargo eventually will land on the island, but the ship is not allowed to dock and leave cargo on its return. The cargo must change ships to a U.S.- flagged vessel, considerably raising costs. The Jones Act needs major revision now.

The Jones Act makes it significantly more expensive to transport goods to places like Hawaii, Alaska, Puerto Rico, or Guam. Not only does the Jones Act bar foreign competition, but ships built in the U.S. are four to five times more expensive than ships on the world market. This cost comes on the shoulders of all Americans, especially those living in places outside of the “lower 48.”

The Jones Act’s intent a century ago was a vibrant U.S. shipping industry. Yet its high-cost protectionist measures have had the opposite result. Furthermore, studies that promote the Jones Act are funded by special interest groups that economically benefit from the status quo and are behind the times.

A partial repeal of the Jones Act – limiting it to the contiguous United States – would be the first step forward to benefit those states and territories most harmed.

Let’s look at Puerto Rico. As highlighted by the Cato Institute as far back as 1930, economist Victor S. Clark noted how the Jones Act hurt Puerto Rico’s economy. A U.S. government commission’s call for its modification to assist the Island in 1966 went unheard. In 2002, a study by the Government Development Bank of Puerto Rico detailed the negative economic impact of the Jones Act and proposed reform. In 2017, after Hurricane Maria, many experts urged the U.S. government to waive Section 27 as one of the most immediate remedies to aid. It did not happen. As recently as 2020, the RAND Corporation cited the Jones Act as a leading impediment to the island’s economic growth.

Waiving the Jones Act would be a game-changer for places like Hawaii. It would provide immediate economic relief. The Grassroot Institute of Hawaii quantifies the cost of the Jones Act to Hawaii at around $1.2 billion a year. In sum, the Jones Act annually costs each Hawaii resident more than $645 each year. The study goes on further to show that the removal of the U.S.-built requirement of the act would save the state $531.7 million a year, add 3,860 jobs and generate $30.8 million in state and local tax revenues.

The law protects non-competitive shipbuilding and cargo companies and harms economic stability and growth. It hurts those it once claimed to protect – millions of American citizens. Bills pending in Congress –such as Rep. Case’s H.R. 300, the Noncontiguous Shipping Relief Act — are the first step to make sure the stranglehold of the Jones Act ends. The benefit to the economy of places like Hawaii, Alaska, Puerto Rico, and Guam would be substantial and immediate. Their residents deserve fair treatment and fair prices – and so do those who visit. A partial repeal of the Jones Act will restore pleasure to a trip to paradise.