A Tale of Two Debt Ceilings

With the House of Representatives approving a Senate bill to end the government shutdown and raise the debt ceiling, a dysfunctional 16 days has finally come to an end. Among the negative effects of the shutdown was the furloughing of hundreds of thousands of government workers, delayed hiring, temporary closure of federal landmarks and parks, and about $24 billion of lost economic activity according to the ratings agency, S&P. One effect, which is strangely missing is a negative impact on global stock markets. One would expect prices to have suffered as they did in the run up to the last debt ceiling deadline in the summer of 2011, but equity markets around the world rallied in the days leading up to the October 17th deadline.

The last two debt ceiling crises ended in similar ways; default was narrowly avoided at the last minute after weeks of partisan politics devoid of compromise. The market reactions however, were very different. The average performance of five major global stock indices (Dow Jones Industrial Average, FTSE 100 in London, CAC 40 in Paris, DAX in Frankfurt, and Honk Kong’s HSI) in the five trading days before a deal was announced yesterday was a 2.72% increase in value. The average movement for the same indices in the five days leading up to a 2011 deal was a 2.20% decrease in value. What conclusions can be drawn from the two market reactions to the debt ceiling crises?

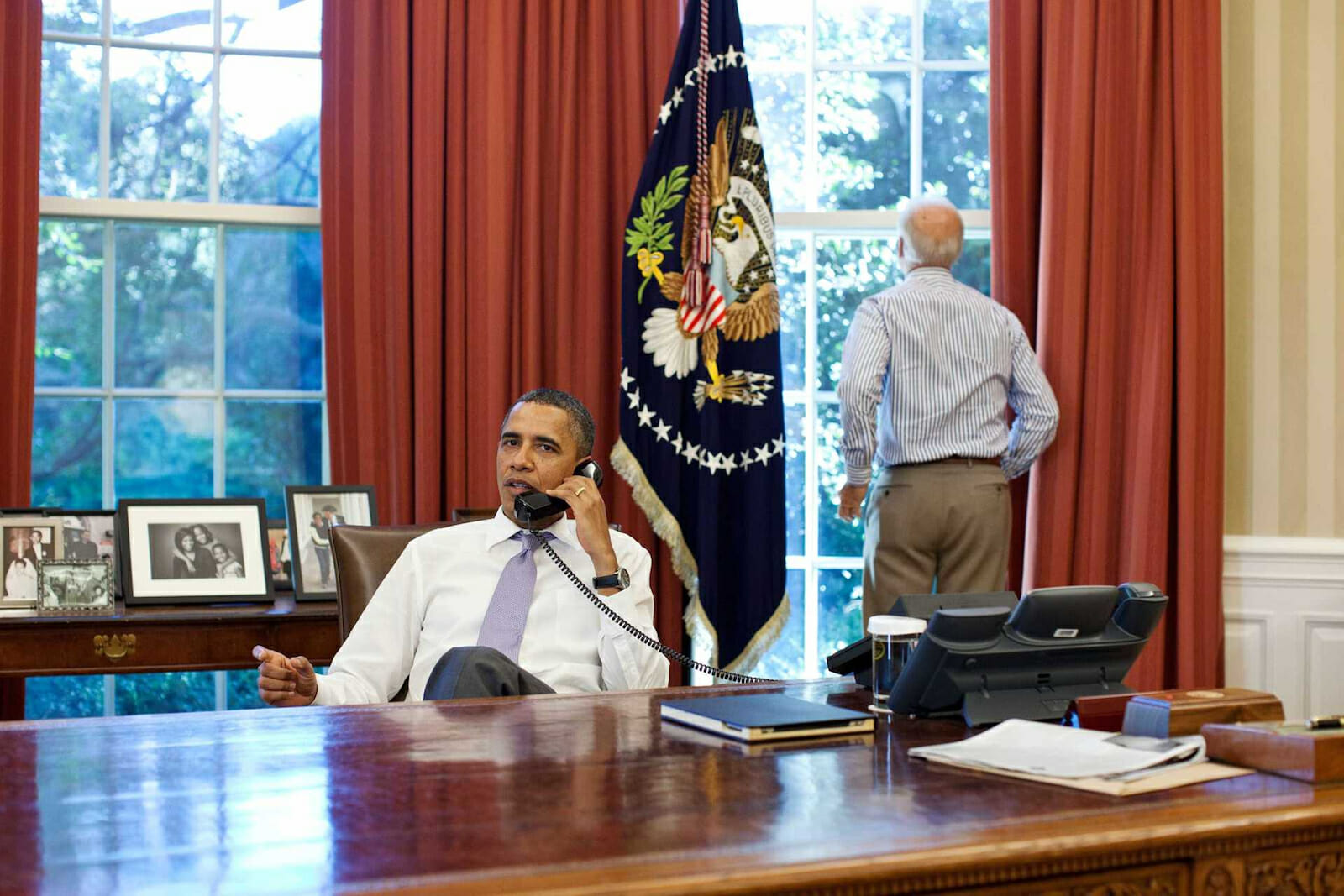

Perhaps investors approved of part of the GOP’s tactic of using a government shut down and threat of a debt default as leverage to try and defund or significantly change the Affordable Care Act or ‘Obamacare.’ Given the way the approval ratings of the GOP have plummeted as well as the economic effects, this seems about as likely as President Obama and Senator Ted Cruz vacationing together next summer.

Part of the difference in the ways the markets responded during the last two debt ceiling deadlines could be the fact that Europe was also in a much worse situation two years ago. The Eurozone was in the middle of the sovereign debt crisis at the time, which caused widespread fear around the world that Europe would crumble economically. The situation has since improved considerably. The EU and other parties involved were able to reassure markets that they would do whatever necessary to keep the Eurozone together and governments of the debt ridden countries accepted painful austerity measures in exchange for assistance. The economic situation is now slightly improving for the worst affected countries such as Spain and Greece, but there is a very long road ahead.

This time around, there was the background of the ongoing government shutdown accompanying the risk of the US defaulting on its debts. The immediate economic consequences of the shutdown and future effects such as a projected slower growth in the US and downward projections of hiring were apparently not as distressing to investors as was the situation in Europe.

What is probably happening is that investors are currently so bullish that even recurring government dysfunctionality in Washington is not enough to dampen spirits. For the past two years the average growth in the five markets analyzed above, has been 32.77%. The reaction seen in the last week is part of this positive outlook that equity investors have had for a while now. One can only imagine the gains that would be seen in markets, especially on Wall Street, if both parties in Washington were able to work together well enough to pass agreements such as commonsense fiscal reform and an immigration bill that is stuck in the House of Representatives.

Other economic indicators from the last two weeks however, have not been as positive. US interest rates the Treasury has had to offer to attract skeptical investors have jumped and US consumer confidence levels have hit nine month lows.

If the problems in Washington were not enough to scare equity investors, then it is hard to imagine what could. Hopefully this is not a case of “irrational exuberance,” as Alan Greenspan would say and the real economy will continue to grow along with equity markets. Unemployment has been coming down steadily in the last two years but unfortunately the hiring increases are nothing in comparison to price movements in the stock markets. There are millions of job seekers hoping employers will follow the optimism shown by investors. For this to happen, however, Washington politicians will have to do more than convince they are not reckless enough to default on sovereign debt.